[ad_1]

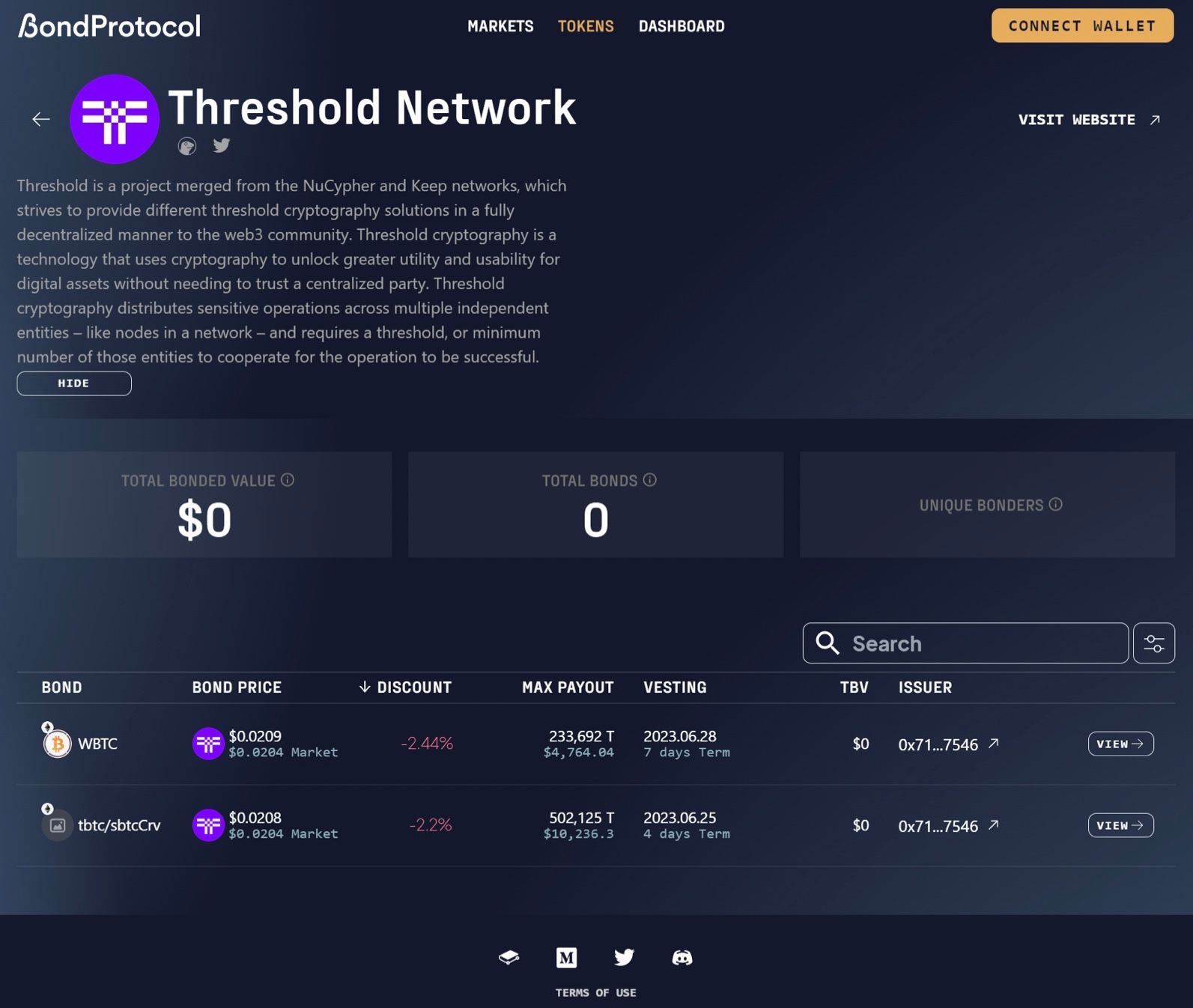

As a part of Threshold’s efforts to extend consciousness and utilization of tBTC, as we speak we launch our first bonding program, which permits individuals to swap tokens they maintain (e.g., WBTC or Curve LP tokens) for discounted Threshold work tokens (T) which might be delivered after a time period (the maturity of the bond). This course of is managed by the Bond Protocol in a trust-minimized method.

Advantages to token holders embrace the flexibility to accumulate T tokens at a reduction (these permit the holder to take part in Threshold governance and might also be staked to run the Threshold Community and for offering liquidity, each of which earn rewards). Threshold Community advantages from elevated market liquidity for the work token through Protocol Owned Liquidity, which is most popular over paying to lease liquidity that may vanish as suppliers chase increased yield elsewhere.

An Introduction to Bond Protocol

On the planet of decentralized finance (DeFi), protocols face the continued problem of strengthening their treasuries and navigating the ever-changing panorama of fundraising and liquidity provisioning. That is the place Bond Protocol emerges as an answer, empowering protocols to diversify their treasuries, fund development initiatives, and fortify their monetary foundations.

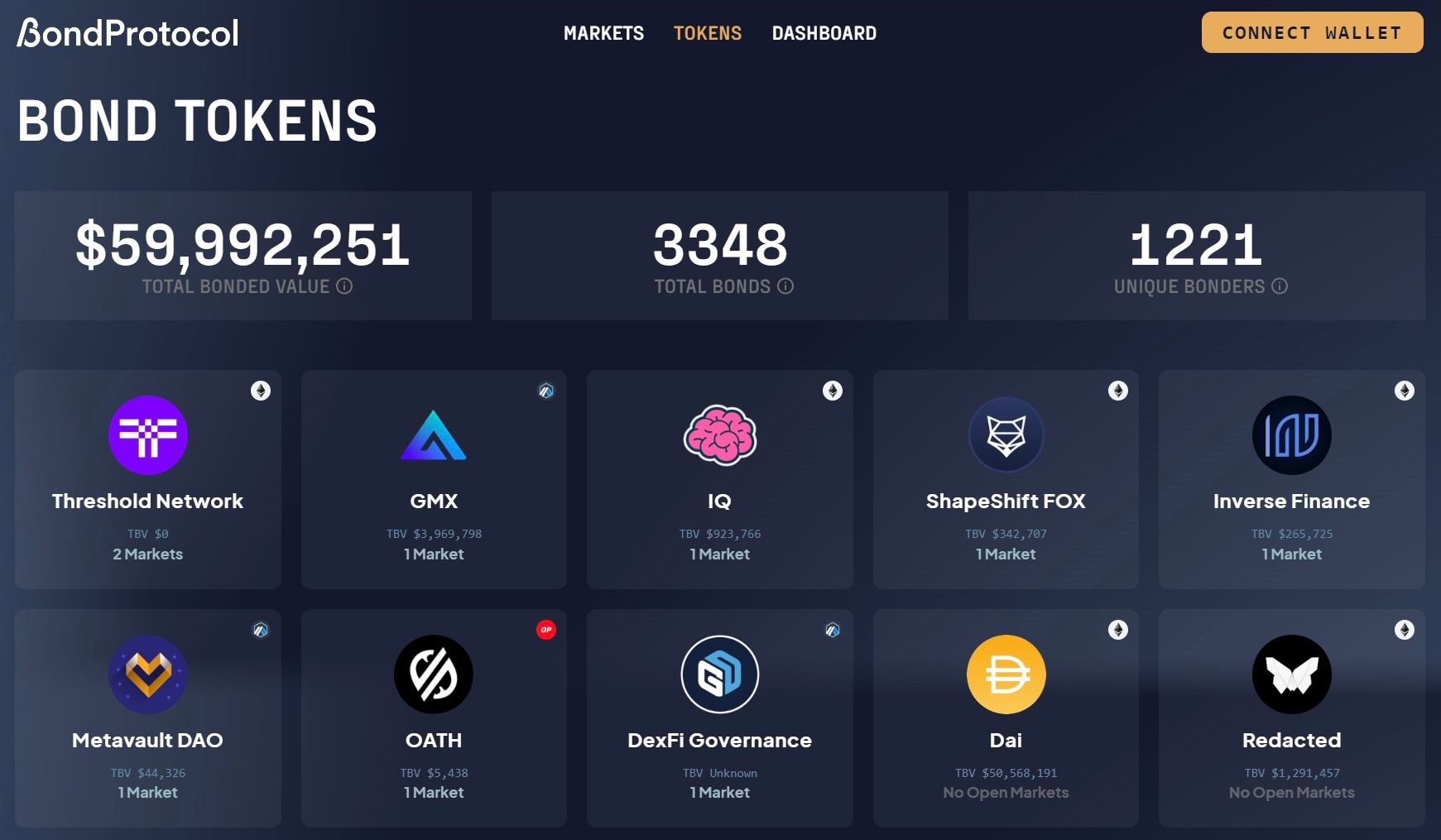

Bond Protocol revolutionizes the normal fundraising mannequin by offering permissionless bond marketplaces, the place issuers can simply deploy a bond market and provide tokens at set or variable alternate charges for different ERC-20 tokens or liquidity pool tokens. Different key options embrace composability of Bond Tokens for secondary markets and a modular framework for flexibility and adaptableness. Since launch in October 2022, Bond Protocol has facilitated ~$60M total-bonded-value (TBV) and has been utilized by over 20 protocols.

TIP 47 – Liquidity Bootstrappening Half 2: PCV

Threshold Enchancment Proposal 47 is a part of a collection of three proposals the group accredited to bootstrap tBTC liquidity. TIP 47 licensed the Threshold Bond Program to assist the Threshold Treasury Guild (TTG) proceed to develop tBTC liquidity and additional diversify Threshold’s Treasury.

Named Liquidity Bootstrappening Part 2 – Protocol Controlled Value (PCV), the purpose is to boost tBTC liquidity and set up important protocol-owned liquidity (POL) rooted within the oldest and largest crypto-asset, Bitcoin. The plan entails a number of phases to create a DeFi income flywheel owned by the Threshold DAO and managed by the TTG.

Unlocking Liquidity: Threshold Launches Bond Program with Bond Protocol

The hassle begins with two totally different Bond market choices: a Curve LP Bond market and a WBTC Bond market. Liquidity suppliers are provided the chance to bond their positions for T, using Bond Protocol as a permissionless platform for the alternate. Subsequent phases of this system will probably be developed and rolled out by the TTG with steering from the Bond Protocol staff. Threshold DAO accredited a price range that will probably be managed and reported on a month-to-month foundation by the Treasury Guild. The allotted funds embrace 10M T tokens for vote incentives on platforms like Votium and 40M T for direct buy of BTC-denominated Protocol Managed Worth (PCV), with flexibility to regulate investments as wanted.

In October of 2022, we revealed “Three Pillars of DAO Treasury Management”, and whereas a few of the info has modified, akin to tBTC being reside and producing income for the protocol, the general objectives and pillars of the Threshold DAO’s Treasury Administration and the TTG’s technique stay the identical. We’re excited to discover how bond applications can turn into one other instrument for furthering these objectives.

On Friday, June ninth, Threshold DAO contributors hosted a Twitter House AMA with Bond Protocol to debate the Threshold Bond Program, the Threshold Treasury Guild’s objectives, and the way the Threshold Bond Program will assist us obtain our formidable treasury objectives. The House was recorded and is offered for replay on Twitter.

To take part within the Threshold Bond Program, go to the Bond Protocol dApp. In case you have questions, each communities can be found on Discord. We invite everybody to affix our communities on the Threshold Discord and the Bond Protocol Discord. To maintain up with the newest Threshold information, follow Threshold on Twitter and subscribe to the Threshold Time e-newsletter.

[ad_2]