[ad_1]

An extended-dormant Ether whale who participated within the Ethereum Preliminary Coin Providing (ICO) may be about to stake an enormous 32,015 ETH tokens, in line with on-chain analytics-focused Twitter account @lookonchain.

The ICO participant staked 48,992 ETH again in October, ending six years of dormancy on the time. In accordance with @lookonchain, the whale transferred 32,015 ETH tokens to a brand new tackle earlier this week, which they assume the whale could also be about to stake.

The Ethereum ICO whale obtained 120,000 ETH tokens on the genesis of the Ethereum mainnet in 2015 throughout three separate wallets. In the event that they do stake an extra 32,015 tokens, which means the whale could have staked 67.5% of the 120,000 tokens they obtained on the Ethereum ICO.

Extra ETH Shifts In direction of Staking

The above-noted whale’s (doable) shift in the direction of staking a higher portion of its ETH holdings displays a shift within the ETH market. ETH staking first grew to become doable on the beacon chain again in late 2020.

However up till now, most ETH house owners have opted to not stake their tokens, regardless of engaging yields of at the moment round 7-8% for node operators and 4-5% for staking pool individuals.

That’s as a result of, in the meanwhile, staked ETH tokens can’t be withdrawn. In accordance with Ethereum, the dearth of flexibility in staked ETH withdrawals was to guard the community’s integrity because it transitioned from proof-of-work to proof-of-stake.

However that transition has now been accomplished (the “Merge” occurred final September). And Ethereum builders are engaged on the blockchain ecosystem’s subsequent huge improve, the so-called “Shanghai” exhausting fork that’s at the moment scheduled to happen earlier than the top of March.

The upcoming improve will enable staked ETH to be withdrawn for the primary time. Whereas withdrawals gained’t be instant, the shift in the direction of higher withdrawal flexibility appears to be attracting extra ETH house owners to staking.

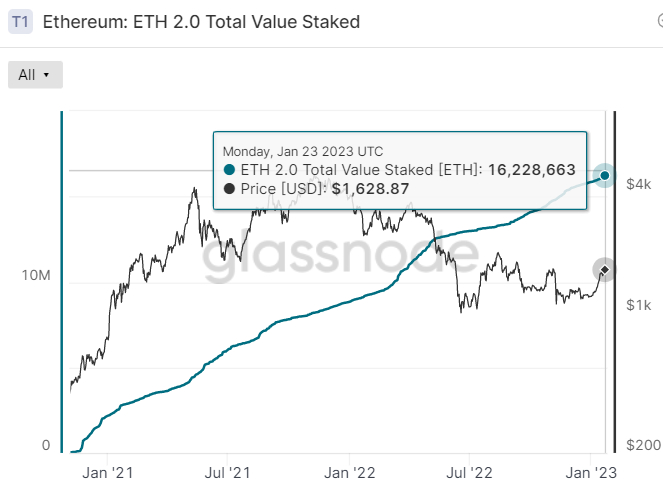

Since September 2022, when the merge occurred, the variety of staked ETH has risen by about 2.7 million ETH to 16.2 million, which means that at the moment round 13.5% of the ETH provide is locked in staking. That’s nonetheless a far cry from staking participation on Ethereum rival Cardano’s blockchain, which has a participation charge of over 70%, thanks for its versatile withdrawals. However the development appears to be in the direction of rising staking participation.

How Larger Staking Participation Can Enhance ETH’s Value

Staking itself is a optimistic for ETH’s worth – why personal a cryptocurrency that provides no yield in anyway when you would personal a cryptocurrency that provides a predictable yield, many crypto traders might ask.

However up till now, the dearth of flexibility in withdrawals was deterring traders who worth liquidity over a gentle yield. Now ETH traders can have (nearer to) each. As ETH staking participation rises, that ought to increase ETH for just a few causes.

To start with, it encourages HODLing, with HODLers assured to get at the very least a 5-8% return (relying on whether or not they’re a node operator or staking pool participant) on their staked ETH, no matter market circumstances.

Assuming a majority of these attracted into staking given its new flexibility do find yourself HODLing their ETH tokens, this additionally ends in a discount of the widely accessible provide of ETH tokens. Ether consumers will primarily be fielding promote provides from a smaller pool of keen sellers.

Many analysts assume {that a} shift to elevated staking participation could possibly be a key driver of long-term appreciation within the worth of ETH. As crypto matures as an asset class and worth fluctuations have a tendency in the direction of that which is regular in conventional monetary markets, many count on main monetary establishments to change into more and more drawn to ETH staking, with some referring to ETH because the bond of the crypto universe.

Different drivers of long-term ETH appreciation are anticipated to be components such because the blockchain’s continued efforts to improve (sharding might make Ethereum extra scalable later this yr), its continued mainstream adoption (non-zero stability addresses ought to quickly hit 100 million) and the truth that it’s now a deflationary asset.

Ethereum Alternate options

If you happen to’re in search of different high-potential crypto tasks alongside ETH, we have reviewed the highest 15 cryptocurrencies for 2023, as analyzed by the CryptoNews Business Discuss staff.

The checklist is up to date weekly with new altcoins and ICO tasks.

Disclaimer: The Business Discuss part options insights by crypto business gamers and isn’t part of the editorial content material of Cryptonews.com.

[ad_2]