[ad_1]

As Chainlink struggles to push up out of consolidation, LINK worth is presently up +2.9%, however with market consideration shifting to a brand new mining protocol – is Chainlink going to zero?

This comes following a sensational breakout transfer by LINK worth over the past two months, which has seen the main oracle challenge smash above 16-months of resistance in robust rally type.

1/ 🚀 Simply in from a dwell skilled session by BNP Paribas & Chainlink Labs, these genuine photographs showcase how Europe’s second-largest financial institution is embracing #Chainlink’s blockchain tech. 🏦✨

This isn’t a drill or a photoshop job,

𝐢𝐭’𝐬 𝐚 𝐟𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥… pic.twitter.com/fA4iYB0syF— Quinten | 048.eth (@QuintenFrancois) December 1, 2023

Fuelled partly by a broader market restoration, Chainlink’s spectacular pump has additionally been sustained as a consequence of market pleasure about an upcoming Chainlink 2.0 upgrade.

$LINK SEND IT 🚀🚀 pic.twitter.com/mOmAe68hJL

— UNKNOWN TRADER (@Learnernoearner) December 1, 2023

Market sentiment is consequently optimistic, with distinguished merchants on crypto Twitter (X) highlighting a bullish shift in LINK’s consolidation posturing.

LINK Worth Evaluation: Is Chainlink Going to Zero as LINK Worth Continues to Battle Consolidation?

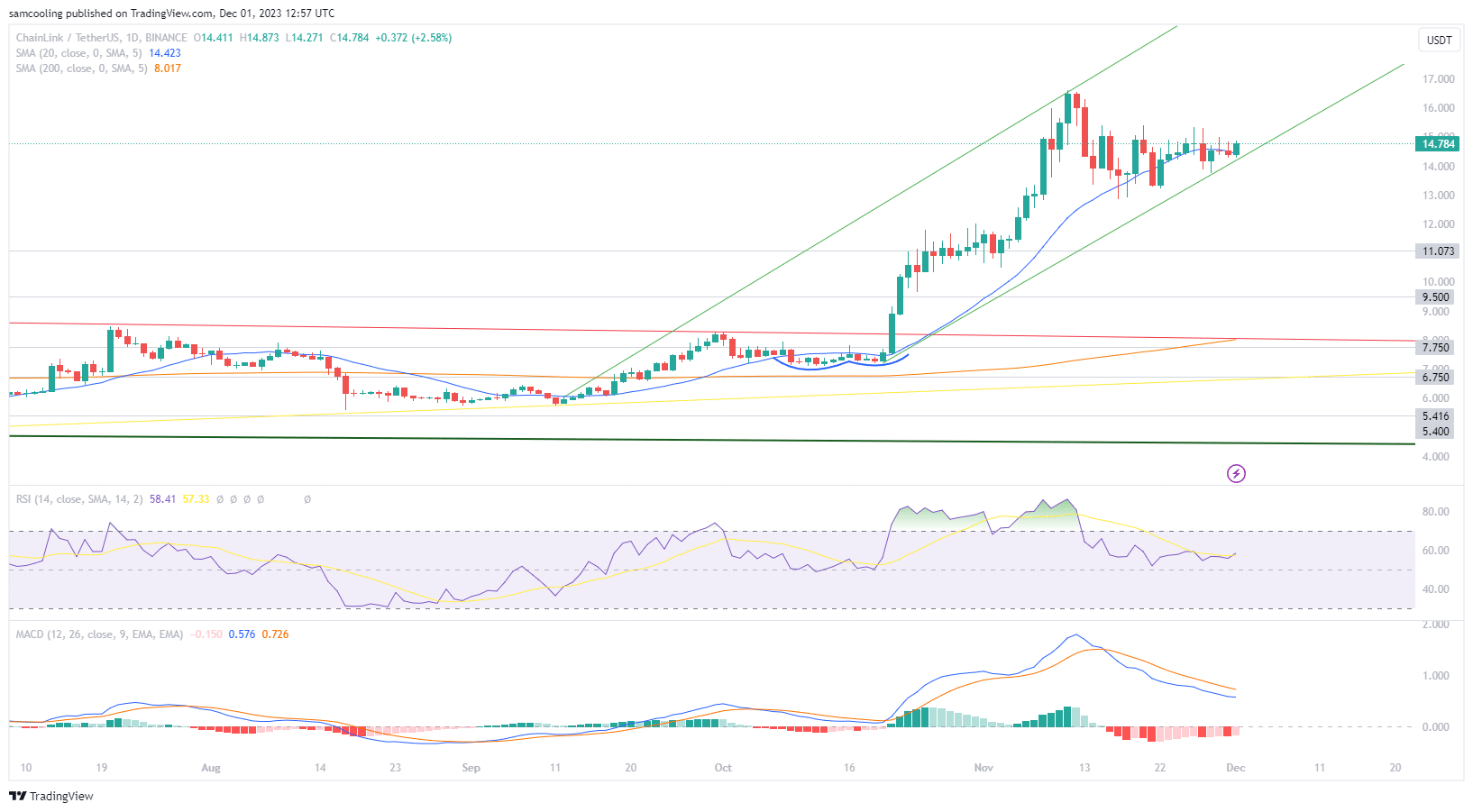

As LINK fights to push out of the consolidation zone, Chainlink is presently buying and selling at a market price of $14.78 (representing a 24-hour change of +2.58%).

This comes as LINK worth hammers again above the 20DMA (sat at $14.5) , a key transferring common which has supplied help to a lot of current upside actions, in a essential reclamation that leaves LINK poised to push up larger.

The profitable defence of the 20DMA has been triggered by collision with the decrease trendline of the localized breakout channel, signalling that market sentiment stays bullish when confronted with trendline resistance – indicating worth would possibly transfer up quickly.

Nonetheless, there are important resistance ranges over-head with LINK worth first concentrating on a break above $15 forward of a re-test of the native excessive at $16.

But, situations appear ripe, with the RSI indicator cooling down considerably amid the -22% retracement transfer throughout November, now signalling at 58.24 – a comparatively impartial sign that offers LINK worth loads of capability to maneuver up.

However the MACD contrasts this, spotlighting weakening momentum, with minor bearish divergence at -0.15.

General, LINK worth seems more and more robust right here, the well-defended transfer again above 20DMA help has been essential in avoiding a catastrophic retracement transfer, and LINK now appears intent on persevering with actions throughout the breakout rally channel.

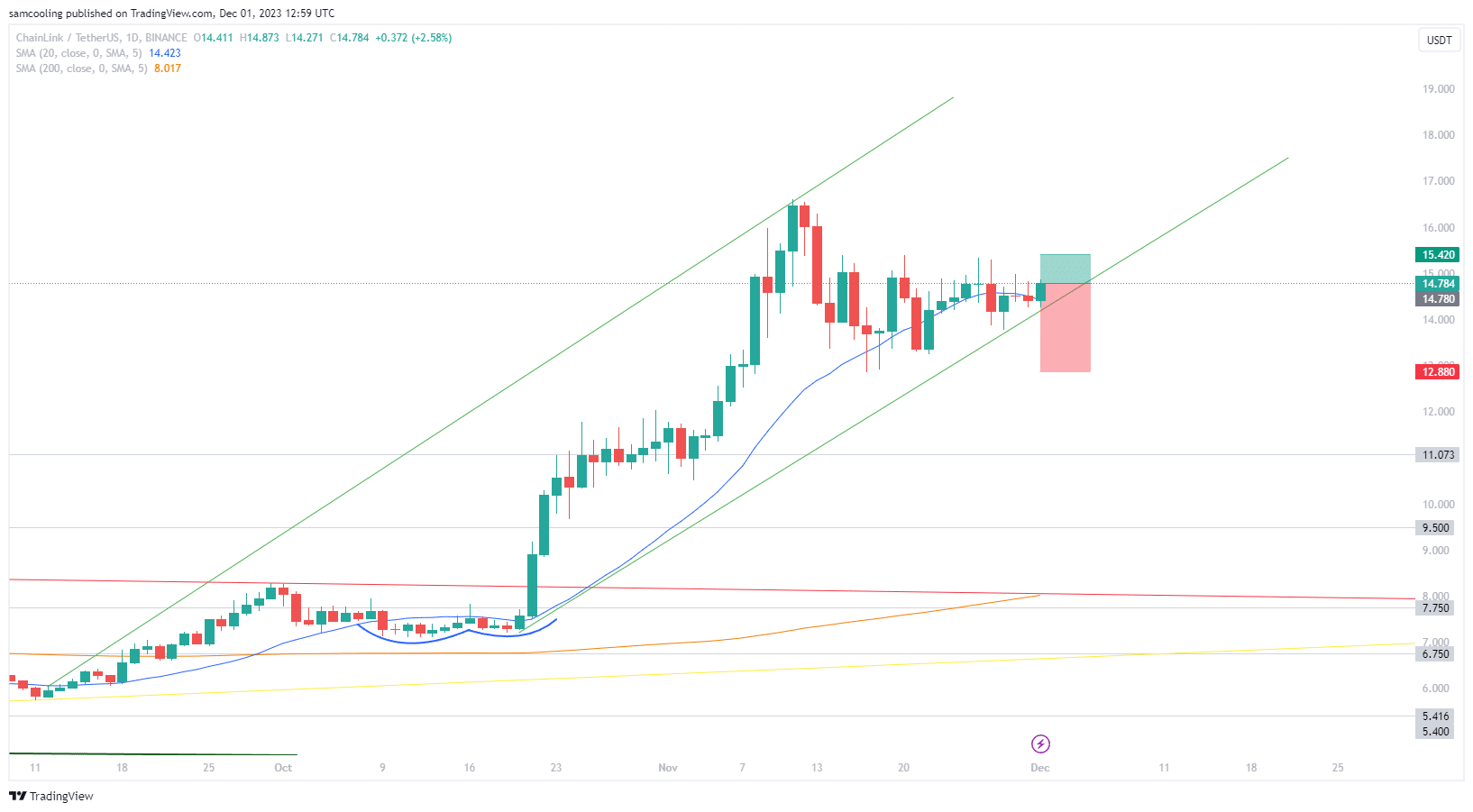

Chainlink’s short-time body upside goal subsequently sits at $15.42 (a possible +4.33%).

Whereas draw back threat from right here might see LINK worth fall all the way down to $12.88 (a possible -12.86%).

Due to this fact Chainlink carries a present threat: reward ratio of 0.34, a foul entry, characterised by late-stage entry, however actually not going to zero anytime quickly.

However whereas LINK Worth presently presents an unattractive threat: reward providing, an rising mining protocol presale is capturing the eye of markets.

LINK Worth Retracement Various? Don’t Miss Bitcoin Minetrix $BTCMTX Presale As $4.6M Raised

Dive into the revolutionary world of Bitcoin Minetrix and its pioneering stake-to-mine system – because the skyrocketing presale smashes +$4,604,548 raised.

Providing an attractive 141% Staking APY, Bitcoin Minetrix supplies a platform the place customers should buy, stake, after which watch because the rewards begin accumulating.

The true essence of passive revenue within the crypto world has by no means been this accessible.

@X co-founder Jack Dorsey helps a brand new $BTC pool for miner management.

How do you envision the impression of @ocean_mining on Bitcoin’s journey towards decentralization amidst the upcoming halving occasion in 2024?#BTCMTX additionally triumphs with one other milestone, passing $4,600,000! 🏆 pic.twitter.com/46uLFV2QPL

— Bitcoinminetrix (@bitcoinminetrix) December 1, 2023

With the Bitcoin Minetrix strategy, gone are the times of heavy preliminary capital and navigating advanced mining contracts.

Bitcoin Minetrix Smashes $4.6M Raised as Merchants Rally Towards Bitcoin Mining Centralization

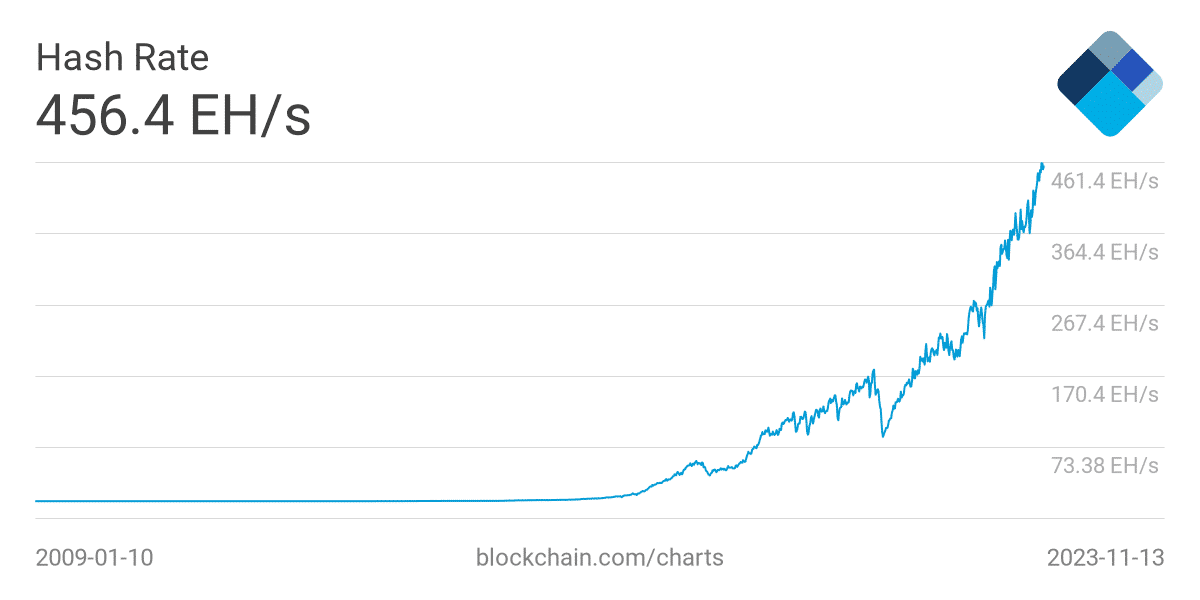

For the reason that 2021 Bull Run, Bitcoin mining has defied expectations by enterprise one thing of a renaissance in community development.

Bitcoin’s Hash Rate (a measure of the whole quantity of computational energy directed at mining Bitcoin blocks) has surged to an unbelievable all-time excessive of 456.6 Exahashes per second (EH/S).

This dramatic development has been fuelled by a considerable enhance within the scale of Marathon Digital and Riot Platforms’ mining operations.

The world’s largest Bitcoin miner – Marathon – reported that for Q3 2023 it had a median hash price of 14.2 EH/s (a 500% development YoY), round 4% of the general community hash (mining round 1153 BTC per thirty days, or, $42.2M USD).

In the meantime Riot Platforms reported a new record hash rate of 10.9 EH/s (mining round 368 BTC per thirty days, or, $13.3M USD), with Riot’s operations anticipated to develop to twenty.2 EH/s by summer season 2024.

However whereas the all-time excessive in Bitcoin community hash price is wholesome for Bitcoin community safety, and clearly worthwhile for rising mining operations, it has additionally begun to lose sight of the unique promise of Satoshi Nakamoto’s decentralization.

Bitcoin mining in 2023 is essentially the most centralized it has ever been in its quick 15-year historical past.

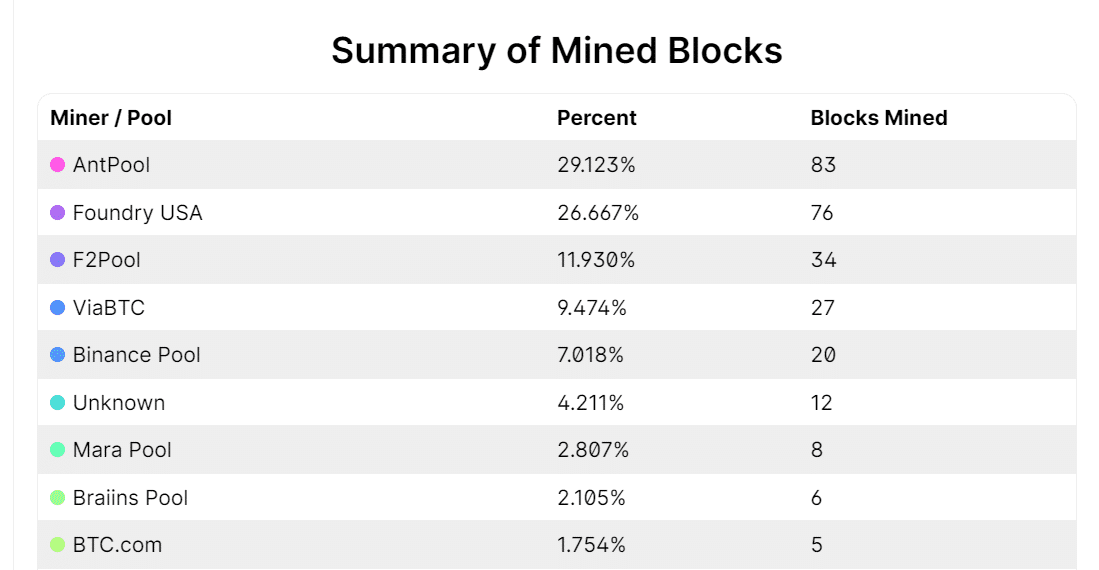

A better take a look at the abstract of mined blocks over the previous 48-hours reveals {that a} surprising 55.79% of all Bitcoin block rewards go to simply two Bitcoin mining swimming pools.

AntPool took the biggest share at 83 blocks mined (29.123%), whereas second largest mining pool Foundry USA mined 76 blocks (26.667%).

This dwarfs the variety of blocks mined by even third place F2Pool (34 blocks mined, round 11.93%), highlighting the rising problem of elevated mining centralization.

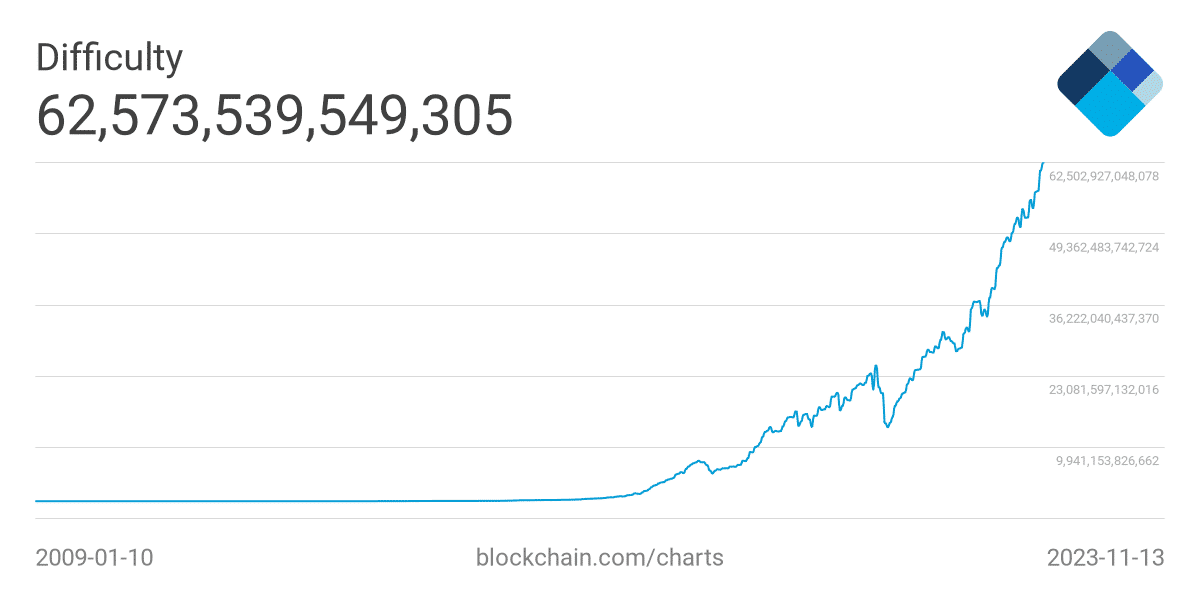

This heightened community exercise, and elevated centralization of mining energy has turn out to be clearly mirrored within the consequent all-time excessive within the issue price for mining Bitcoin.

At present standing at 62,573,539,549,305 – it has by no means been tougher for the person participant to have interaction in worthwhile Bitcoin mining.

This problem of heightened community issue, fuelled by elevated competitors and centralization of mining energy, has created the necessity for brand new options for the retail investor to take part in Bitcoin mining – each for community decentralization and preserving Bitcoin as a worthwhile exercise for the person.

Enter Bitcoin Minetrix, which was launched to ship safe and clear Bitcoin mining rewards for the retail investor via an revolutionary, decentralized Bitcoin cloud mining strategy.

Key Highlights of the BTCMTX Benefit Over PYTH Worth Retracement:

- Distinctive Edge within the Market: In an trade full of quite a few cloud mining platforms, Bitcoin Minetrix carves a distinct segment for itself. Because the first-ever tokenized Bitcoin cloud mining initiative, it presents an automatic system that’s geared for cloud-based Bitcoin mining, setting a brand new normal for the trade.

- Security First with Ethereum Blockchain: Bitcoin Minetrix operates on the tried and trusted Ethereum blockchain. This ensures top-notch safety and reliability, permitting customers to sidestep the dangers related to exterior mining swimming pools, and providing a safeguard towards potential fraudulent cloud mining companies.

- Championing True Decentralization: At its core, Bitcoin Minetrix upholds the ethos of decentralization. In an age the place centralization usually introduces vulnerabilities, Bitcoin Minetrix breaks the mould, redistributing mining earnings from large companies to particular person retail buyers via its novel Stake-to-Mine system.

- Tapping into the Bitcoin Halving Alternative: Completely poised to take advantage of the upcoming Bitcoin halving, Bitcoin Minetrix supplies buyers with a golden alternative. The upcoming halving might sound daunting for miners as a consequence of lowered block rewards, however traditionally, such occasions have pushed up Bitcoin’s worth. Bitcoin Minetrix supplies a platform for buyers to faucet into this potential surge, sans the related capital dangers.

- The BTCMTX Presale Alternative: The continuing BTCMTX presale has already garnered important curiosity, with over $4.6m raised in the direction of its $5.2M purpose. At a aggressive worth of simply $0.0119 per token, early buyers have a novel likelihood to be on the forefront of this stake-to-mine evolution.

In sum, Bitcoin Minetrix is about to redefine the Bitcoin panorama. With its revolutionary methodologies, stringent safety measures, and the huge potential of its stake-to-mine mechanism, it beckons as a profitable alternative for early-bird buyers.

Safe your place on this transformative journey by becoming a member of the BTCMTX presale right this moment.

Disclaimer: Crypto is a high-risk asset class. This text is supplied for informational functions and doesn’t represent funding recommendation. You possibly can lose your whole capital.

[ad_2]