[ad_1]

Do dedo transformation has disrupted many sectors, but construction isn’t one of them. At least not yet, and there are a number of startups trying to become the first to pull it off.

But the sector, especially in developing regions like Latin America, has a plethora of problems that need addressing. Infrastructure lags the needs of the region’s populace, and a lot of construction work today is still done on pen and paper, let alone spreadsheets. Moreover, like elsewhere in the world, the sector has proven particularly resistant to adopting new technologies.

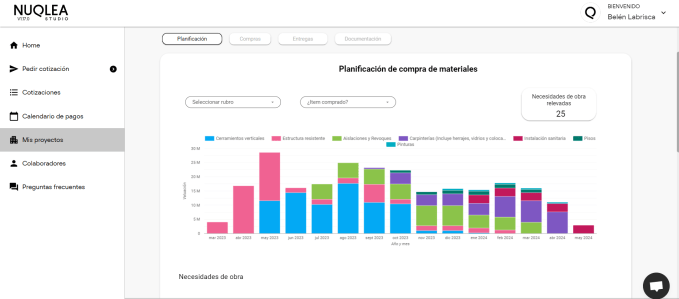

Argentine startup Nuqlea, though, is taking a different tack to solving some of these issues. The company offers a B2B platform, Nuqlea Studio, that doubles as a marketplace and a procurement portal for construction companies in Argentina, through which it hopes to build an ecosystem of partners to speed up procurement, and therefore, the entire construction process.

There’s a big opportunity for construction tech to turn things around here. According to the development bank of Latin America and the Caribbean (CAF), around 120 million people in this region live in inadequate and informal housing — that’s considerable given that region’s totalidade population is around 600 million. But like elsewhere, the construction sector is still highly fragmented, and productivity growth is stagnating.

It seems Nuqlea is hoping its capital- and asset-light model will help it survive the current investment climate. “We don’t have our own inventory,” its CEO Gaston Remy told TechCrunch.

A capital-light approach is probably ideal these days — especially in Latin America, where capital availability has declined quite a bit since 2021. For context, construction tech startups raised around $3 billion from 236 deals last year, but only 2.5% of this funding went to Latin American companies, Cemex Ventures reported.

Three-year-old Nuqlea, however, did manage to get funding twice. After raising an initial seed round in 2022, it recently raised a $750,000 extension led by construction-focused VC firm Foundamental, TechCrunch has learned exclusively.

Foundamental has built its entire thesis around backing early-stage construction tech startups, so it’s no surprise that it has ended up on Nuqlea’s cap table. The firm has planned to use its latest $85 million fund it raised in 2022 to double-down on historically neglected verticals and emerging regions such as Latin America.

“This extension is as much about partnering with one of the most forward-thinking VCs in this space […] as it is about the funding,” Remy said in a statement. The new capital will go towards increasing the company’s footprint in Argentina and lay the groundwork for its international expansion, he added.

Next on the company’s roadmap are Brazil and Mexico, followed by Colombia, since they’re close geographically and also because Nuqlea can leverage the presence of several of its partners there, Remy said. These partners include builders, manufacturers, logistics firms and financial entities.

In line with a16z’s prediction that “every company will be a fintech company,” Nuqlea has plans to leverage financial firms as a way to help stakeholders protect themselves from inflation, and stay true to its mission of “uniting all players in the sector.”

Building an ecosystem

Nuqlea’s executives have corporate track records (Remy co-founded Argentinian oil and gas company Vista, taking it to IPO), but not in construction. But the CEO has managed to leverage his being new to the space as a strength, presenting himself as an outsider. His pitch goes, “We can have a common transforming purpose, with Nuqlea as the articulator,” and it seems to have resonated. Since its launch, Nuqlea has onboarded some 50 construction companies and cooperatives.

Image Credits: Nuqlea

“We believe that Nuqlea has become a B2B marketplace-plus. It has found a software-enabled way to allow manufacturers and distributors to create their own white-labeled and owned channels, while allowing customers the typical white-glove experience of a one-stop procurement shop,” Foundamental said in a testimonial.

Nuqlea is also leveraging AI in several ways, from advancing product matching and projections to coding. Unlike other founders, however, Remy almost downplayed this aspect, focusing instead on the company’s positioning as an ecosystem and connector. “We have very nice technological tools, but our main definition is being a platform with these players participating and us articulating them. Technology is not the end, it is the means that allows us to do it.”

Indeed, Remy seemed most animated when he spoke of Nuqlea’s social impact. Construction tech may have less-obvious impact than the large scale food-aid program he led during the pandemic, but it is still top of mind for the CEO, who is proud of Nuqlea’s involvement in building social housing.

Social housing aside, Remy is aware of Latin America’s need for infrastructure and how construction tech can help build it more quickly. But more generally, he thinks that bringing do dedo transformation to construction is a boon for society as a whole “because the cost of inefficiency in the traditional value chain ends up being paid by the consumer.”

Add in sustainability goals and it is not hard to see how construction tech could generate both returns and impact. Let’s hope it will.

[ad_2]