[ad_1]

It’s that point of 12 months once we look again on the 12 months’s greatest tech M&A offers. Sometimes by this time, the standard acquisitive suspects like Microsoft, Salesforce, Adobe, SAP Oracle and Cisco have taken at the least just a few large swings. However this 12 months, solely Cisco took a giant chew, finally asserting 11 complete offers.

SAP made a pair smaller offers, however Microsoft, Salesforce, Adobe and Oracle principally stayed on the sidelines this 12 months. The $61 billion Broadcom-VMware deal introduced in Might 2022 lastly closed final month, and Adobe and Figma agreed to finish their $20 billion deal this month, which has been stuck in regulatory limbo because it was introduced in September 2022.

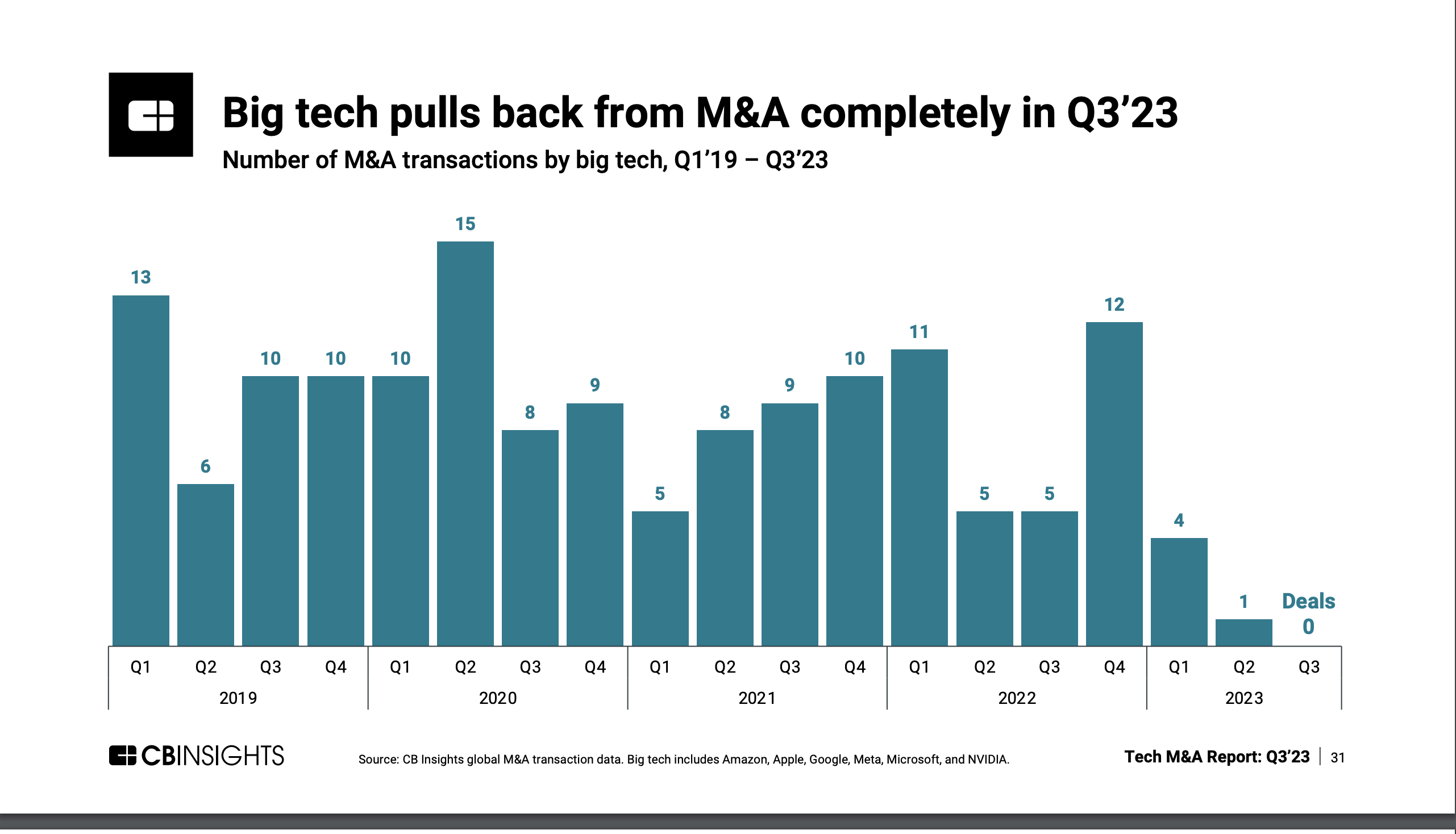

It’s not our creativeness that there are fewer offers from the largest gamers. CB Insights reported zero offers in Q3 this 12 months from Huge Tech. Examine that with 2019, when there have been 10 such offers in Q3, or with 2020, when there have been eight.

Picture Credit: CB Insights

Maybe the excessive price of borrowing put a damper on the offers we noticed in 2023. Lengthy gone are the times of 2020 when the highest offers totaled $165 billion. This 12 months it was simply $67.7 billion, the bottom complete we’ve seen since 2019’s all-time low of $40 billion, the second 12 months we compiled these high deal lists.

It’s price noting {that a} good variety of the offers this 12 months concerned personal fairness corporations both shopping for corporations or promoting them off at a pleasant revenue.

Possibly the smaller offers involving AI mattered extra, like Atlassian buying Loom for $975 million; Salesforce acquiring Airkit.ai for an undisclosed quantity, one among solely two small acquisitions this 12 months; or Snowflake nabbing AI search firm Neeva, additionally for an undisclosed quantity.

Regardless, right here’s what the highest 10 enterprise offers seemed like this 12 months from most cost-effective to most expensive:

[ad_2]