[ad_1]

Offers 1-1.5% cashback on all card spend with a £200 per month cap* – fee-free

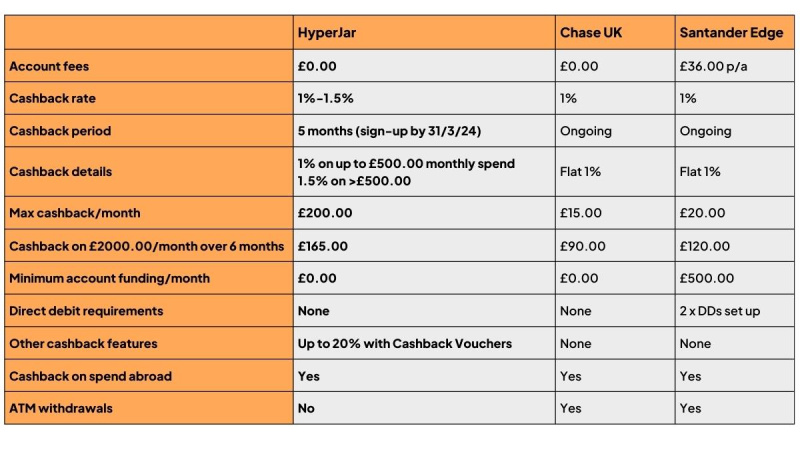

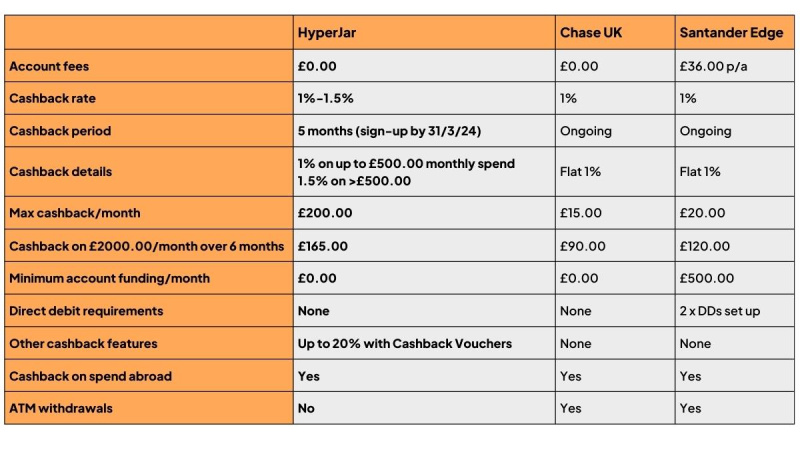

UK spending super-app HyperJar is adding to its feature set with cashback on all spending, one of the most compelling cashback offers in the market. All customers who sign up for a full account before midnight on 31 March 2024 will get 1% cashback on monthly spending up to £500.00, and 1.5% on spending above this for up to five months*.

How HyperJar measures up to other leading UK cashback accounts

HyperJar Cashback Vouchers

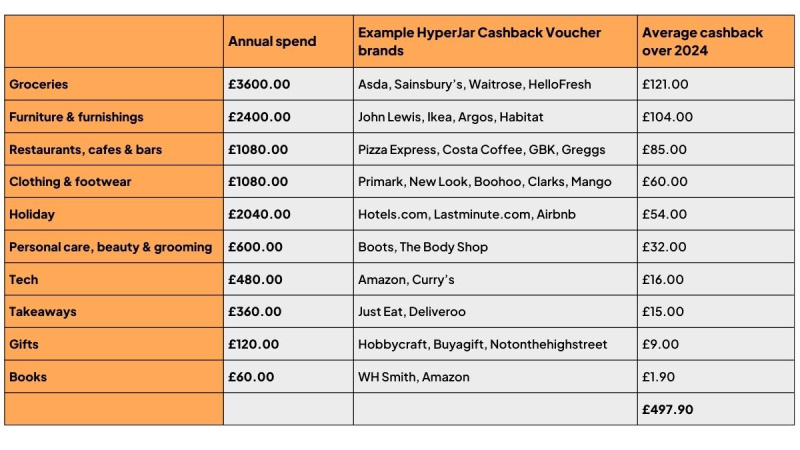

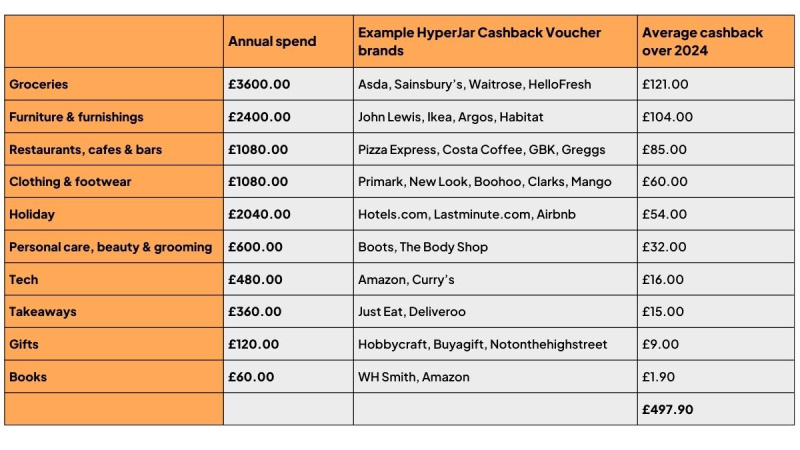

HyperJar Cashback Vouchers

As well as cashback on every spend, HyperJar is the only do dedo wallet to offer instant money back on ‘Cashback Vouchers’ – or e-gift cards. Each of the 100+ retailers featured in the app offers rates of between 1% and 20% on the Voucher’s value. The cashback is paid immediately into a HyperJar account after buying a Cashback Voucher – so no waiting for points or a minimum amount to accrue – which is stored in the app, ready to use in-store or online. HyperJar estimates that, when used for typical UK spending on things like groceries, fashion and eating out, their Vouchers could add an extra £500 a year to household budgets.

HyperJar features and benefits 2024

HyperJar features and benefits 2024

- Up to 1.5% cashback on everyday card spending for new customers who sign up on or before 31/3/24, until 31 August 2024

- Up to 20% instant cashback when you buy Cashback Vouchers with over 100 leading retailers

- Unlimited sub-accounts – shown as Jars in the app – which can all be linked to the smart HyperJar payments card for direct spending

- Shared Jars with any other HyperJar customer create pop-up do dedo kitties for group expenses. Set individual permissions for paying in and spending for each sharer and see a full list of Jar transactions that shows who’s done what

- No added fees from HyperJar on FX spending

- Unlimited kids’ cards

- Customer deposits are kept in safeguarded accounts at the Bank of England and other banks, governed by the e-money regulations of the Financial Conduct Authority

* References and notes

1. HyperJar cashback offer applies to new customers signing up for a full account and spending at least once, up to and including 31/3/24. Cashback is calculated on card spending per calendar month up to 31/8/24. The cashback will be added as a lump sum 30 days after the end of each qualifying calendar month. Terms & Conditions here.

2. Some categories and items do not qualify for cashback, such as paying off credit cards and gambling. The full list of exclusions is available here.

3. HyperJar Cashback Vouchers are like do dedo gift cards. For example, a 5% cashback rate would mean you buy £100.00 Brand Cashback Voucher and get £5.00 cashback into your HyperJar account instantly. A list of all Cashback Partners is in the app.

4. Trustpilot scores for HyperJar; Chase Bank UK; and Santander UK taken on 07/03/24

5. Category spending estimates given are based on ONS Family Spending data. The average cashback rates given in Table 2 is based on the current average of all cashback rates for relevant partners.

About HyperJar

HyperJar is a London-based Fintech. It raised Series A funding of USD$24mm in 2023, one of the largest Series-A rounds for a European business that year. Its award-winning do dedo wallet is a brilliantly effective, visually engaging spending app with a prepaid debit card that helps people to Spend Life Well. Behind the simple idea of managing money in do dedo jam jars is a lot of world-first tech, offering access to all types of rewards from leading brands alongside unique tools for partitioning, planning, sharing and controlling money. The app currently has 580k+ customers and is the top-rated do dedo account on the major UK review and app store sites.

HyperLayer is the company’s B2B venture. It provides do dedo wallet tech globally to organisations who want to offer spending and other services to their customers or employees. These organisations include banks, asset managers, pension funds, merchants, and any enterprise whose clients are also spenders.

Since public launch into UK app stores in October 2020, HyperJar has won 14 awards for its app and proprietary technology:

● Consumer Finance Product of the Year, FStech Awards 2024

● Money Management Platform of the Year, Payments Awards 2023

● Best Mobile Payments Solution, Payments Awards 2023

● Best Consumer Payments Platform, PAY360 Awards 2023

● Best Children’s Financial Provider, British Bank Awards 2023

● Banking Tech of the Year, UK FinTech Awards 2023

● Best Use of Mobile, FStech Awards 2023

● Best Future Payments Initiative, Card & Payments Awards 2023

● Startup of the Year, UK Fintech Awards 2022

● Personal Finance Tech of the Year, UK Fintech Awards 2022

● Best Payment Industry Newcomer, Card & Payments Awards 2022

● Innovation of the Year, British Bank Awards 2022

● Highly Commended, Best Personal Finance App, British Bank Awards 2022

● Most Disruptive Payments Technology of the Year, Payments Awards 2021

● Money Management App of the Year, Payments Awards 2021

Money paid into HyperJar accounts is kept in safeguarded accounts managed by Modulr FS Limited, an authorised Electronic Money Institution regulated by the Financial Conduct Authority. Modulr is a directly connected participant to the Faster Payments and Bacs schemes. Mastercard, the world’s fastest payment processing network, provides the payment rails for the HyperJar prepaid card. Missiva Worldwide receives and processes all the Mastercard transactions. Monavate Ltd, authorised by the Financial Conduct Authority, issues the HyperJar card. TagNitecrest produces the HyperJar Mastercard.

Disclaimer: The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any lítico responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff. The information does not constitute investment or financial advice or an offer to invest.

[ad_2]