[ad_1]

The cryptocurrency market is abuzz with hypothesis as the subsequent week guarantees vital developments. The focal point is the beleaguered crypto trade FTX, which is anticipated to achieve courtroom approval to liquidate an estimated $3.4 billion in cryptocurrencies.

Rumors counsel FTX probably receiving this liquidation inexperienced gentle by September 13. Stakeholders are apprehensive in regards to the attainable hostile repercussions in the marketplace.

Bearish Sentiments Forged a Shadow

Esteemed crypto analytical company IntoTheBlock highlighted that the looming FTX liquidation would possibly dampen Ethereum and Solana’s optimistic strides prior to now week. The agency commented:

“Regardless of optimistic information about Visa and a possible spot ETH ETF, FTX’s impending $3B liquidation might be dictating market motion.”

Learn extra: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

Nevertheless, panic could be untimely. Hitesh.eth, a notable crypto commentator, mentioned that even when FTX secures the approval by September 13, the liquidation may not kick off instantly.

It’s important to notice that FTX’s court documents point out a need to dump as much as $100 million in digital property weekly. This cover would possibly sometimes be stretched to $200 million.

Altcoins Brace for Potential Influence

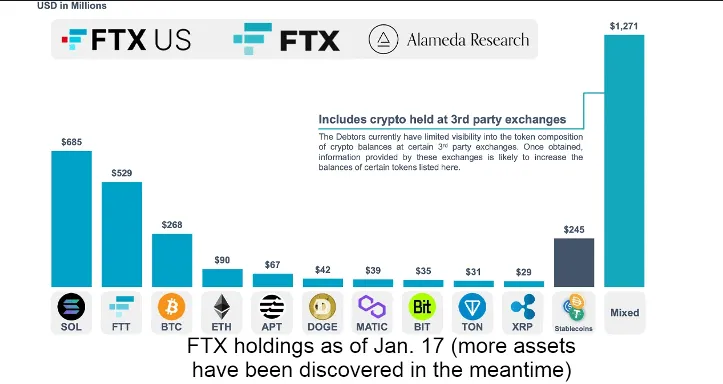

The attainable fireplace sale has ignited worries, particularly in regards to the altcoins in FTX’s possession. Information present that Solana forms the bulkiest portion of their property, valued at roughly $685 million.

This looming uncertainty has triggered a flurry among SOL investors, manifesting in a big 5.1% value dip during the last 24 hours.

As of now, SOL is hovering round $18.52. This downturn sharply contrasts with most different property, which have largely maintained their positions or confronted slight dips.

Learn extra: Identifying & Exploring Risk on DeFi Lending Protocols

Moreover, FTT, the trade’s proprietary token, makes up $529 million of the assets to be liquidated. FTT’s restricted liquidity and market depth elevate queries on FTX’s liquidation technique for these tokens.

FTX’s portfolio additionally encompasses vital chunks of different cryptocurrencies like Aptos, Dogecoin, Polygon’s MATIC, XRP, amongst others.

FTX Ramps Up Restoration Measures

FTX is relentlessly pursuing avenues to recoup property amid its monetary woes, spawning a sequence of authorized maneuvers.

Not too long ago, the trade slapped LayerZero, an omnichain interoperability platform, with a clawback lawsuit, hoping to get better $21 million. Moreover, it has set authorized wheels in movement towards Ari Litan, LayerZero’s Chief Working Officer, demanding $13 million and is pursuing $6.5 million from Skip & Goose, a agency owned by Litan.

Furthermore, FTX is reportedly revisiting promotional fees dished out to sports activities celebrities equivalent to Naomi Osaka and Shaquille O’Neal. Throughout its heyday, the now-bankrupt trade lavished significant amounts on celebs for advertising drives.

As an illustration, Osaka pocketed $3.2 million for her affiliation and endorsements with FTX.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices based mostly on this content material.

[ad_2]