[ad_1]

The Ethereum price has surged by 5.5% at this time, with the coin transferring to $2,298 within the context of a market that has gained by the identical proportion up to now 24 hours.

ETH’s efficiency at this time additionally comes as JPMorgan analysts predict that the altcoin might outperform Bitcoin (BTC) subsequent 12 months, helped alongside by the incoming EIP-4844 improve that may allow Protodanksharding and its scaling upgrades for layer-two networks.

ETH can also be up by 13% within the final 30 days, with the altcoin sitting on a 73% rise up to now 12 months.

And with most analysts predicting a totally fledged bull market in 2024, at this time’s features could also be solely the tip of a really giant iceberg.

Ethereum Worth Prediction as JPMorgan Says ETH Will Outperform BTC in 2024 – Can ETH Attain $100,000?

Now appears to be like like an excellent time to reenter the ETH market, on condition that the coin’s indicators level in direction of incoming features.

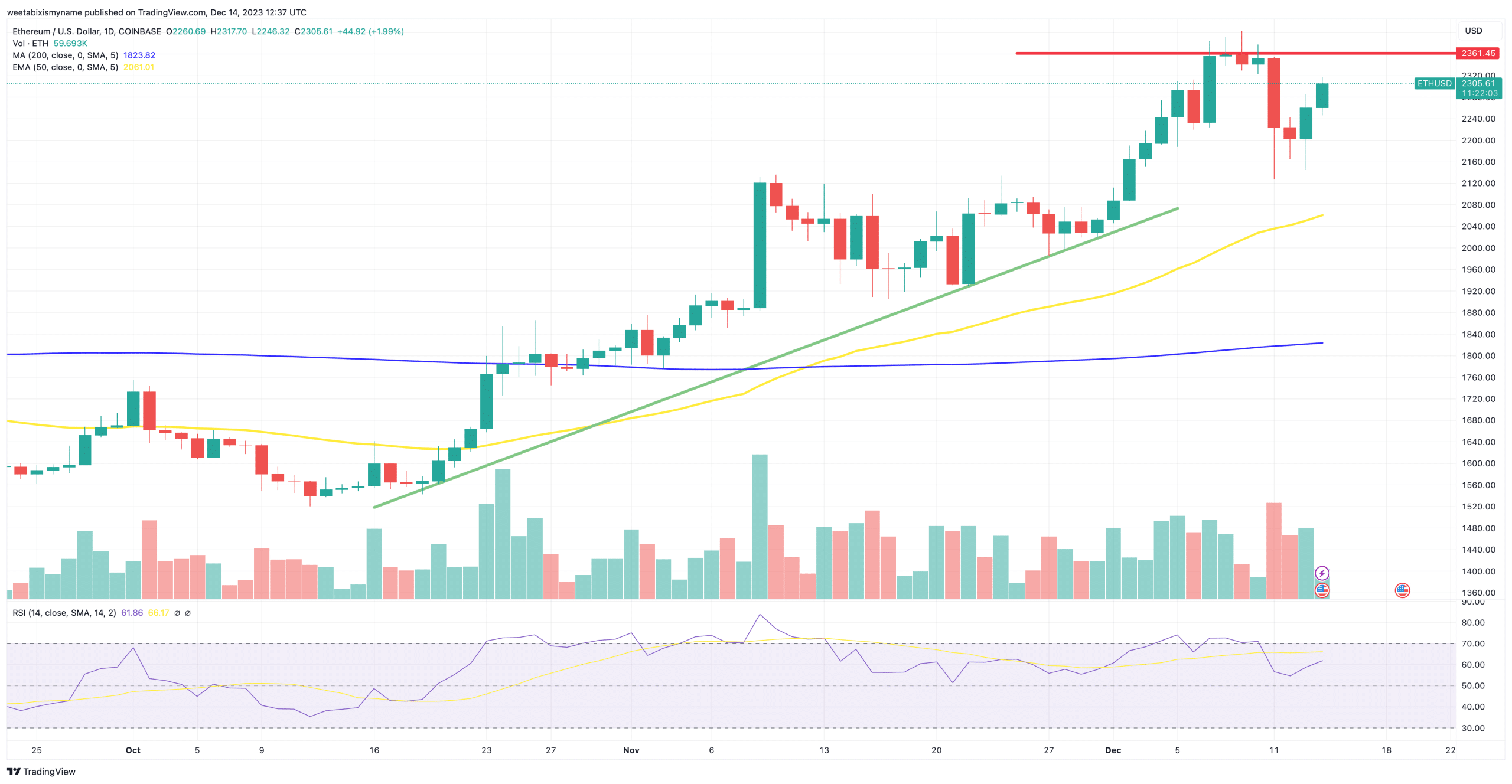

Not solely is its 30-day common (yellow) rising effectively past its 200-day (blue), however the coin’s RSI (purple) has simply previous the 60 stage, signalling rising shopping for stress.

As such, ETH not solely has rising momentum, but in addition has house for additional features within the coming weeks, earlier than it enters overbought territory.

It’s additionally value declaring that the alt’s assist stage (inexperienced) has risen persistently up to now couple of months, resisting all however probably the most minor of losses.

This sits effectively with ETH’s buying and selling quantity, which at $19 billion makes it probably the most closely traded non-stablecoin cryptocurrency save for Bitcoin (BTC).

And as famous above, some analysts suspect that ETH might put up larger proportion features in 2024 than even BTC, with JPMorgan’s Nikolaos Panigirtzoglou writing in a word to traders yesterday that the arrival of Protodanksharding could possibly be a giant consider enhancing the energy of ETH’s fundamentals.

JP Morgan: Ether has the potential to outperform Bitcoin and different cryptocurrencies in 2024 as a result of EIP-4844 improve “Protodanksharding.”

JP Morgan believes the chance of a Bitcoin ETF being accredited and the halving occasion has already been factored into Bitcoin’s worth

— 0xNgaos (@0xNgaos) December 14, 2023

Such fundamentals stay very robust as they already are, with the Ethereum blockchain accounting for more than 50% of the entire sector’s total value locked in.

Ethereum has additionally loved some bullish adoption information this 12 months, with PayPal launching an Ethereum-based stablecoin and Coinbase launch its personal layer-two community for Ethereum.

Because of this the arrival of Protodanksharding – which is able to enable layer-two networks to course of a number of transactions in parallel – will solely enhance the Ethereum worth even additional.

It might attain $3,000 by the primary few months of the 12 months, earlier than topping its present ATH – at $4,878 – in the course of the second half of 2024.

Different Essentially Sturdy Altcoins

As a result of ETH is such a longtime coin, many merchants can also be inclined to diversify a few of their portfolios into smaller cap alts, which can have the potential to outpace the market subsequent 12 months.

Presale tokens have been a very good supply of such outsized features this 12 months, with the most important typically creating momentum earlier than they listing on exchanges.

And one ongoing presale with good momentum proper now could be Bitcoin Minetrix (BTCMTX), a stake-to-mine platform that has raised over $5.2 million in its sale.

#Tether freezes 41 wallets linked to OFAC’s SDN Listing, taking precautionary measures. 🔒

CEO Paolo Ardoino emphasizes a safer #Stablecoin ecosystem.

How do you suppose such actions impression the steadiness and belief in stablecoin know-how?#BitcoinMinetrix attains one other… pic.twitter.com/EOIjneI5f3

— Bitcoinminetrix (@bitcoinminetrix) December 12, 2023

Making use of the Ethereum blockchain, Bitcoin Minetrix is a stake-to-mine platform in that it’s going to allow customers to mine Bitcoin (BTC) by staking its native token, BTCMTX.

Staking offers customers with tokenized mining credit, which they will then spend to pay for Bitcoin mining to happen on their behalf.

This may earn them newly mined BTC, whereas staking may even present contemporary BTCMTX tokens, with the latter having a complete max provide of 4 billion.

Given these two sources of earnings, Bitcoin Minetrix might subsequently find yourself a extremely profitable platform for traders.

Simply as importantly, its streamlined interface and cloud-based system goals to make Bitcoin mining extra accessible than ever earlier than.

The truth that it has already raised over $5 million means that its native token might have a giant itemizing subsequent 12 months, with traders nonetheless capable of be part of the sale by visiting the Bitcoin Minetrix official website.

1 BTCMTX prices $0.0122, though this can rise to $0.0124 in just below three days, which means merchants ought to act sooner fairly than later.

Disclaimer: Crypto is a high-risk asset class. This text is supplied for informational functions and doesn’t represent funding recommendation. You would lose your entire capital.

[ad_2]