[ad_1]

Ether (ETH), the second most beneficial cryptocurrency by market capitalization that powers the smart-contract-enabled Ethereum blockchain, was final up shut to five% on Thursday and simply hit recent highs for the 12 months within the mid-$2,300s.

Ethereum stays the dominant blockchain utilized by Decentralized Finance (DeFi), Non-Fungible Token (NFT) and broader web3 industries, accounting for round 70% of the crypto trade’s $107 billion in complete worth locked (TVL) as per DeFi Llama, which refers back to the complete worth of all crypto locked in good contracts.

Ether has been pumping in latest weeks amid a broader resurgence in threat urge for food throughout the crypto market that noticed Bitcoin this week surge to recent yearly highs above $44,000.

That pump has come amid optimism about anticipated near-term spot Bitcoin ETF approvals and a few doubtlessly imminent dovish monetary policy pivot from the US Federal Reserve, which might result in a extra favorable liquidity atmosphere.

However with main asset managers like BlackRock also moving to create spot Ethereum ETFs, with the Ether provide having latest switched again to deflationary because of bettering on chain exercise and with Ether having considerably lagged Bitcoin’s rally this 12 months (ETH is up 96% year-to-date versus BTC’s 164% acquire), the case for sturdy near-term Ether value good points sturdy.

Current technical developments additionally help the case for additional upside, with near-term value predictions prone to stay bullish because of this.

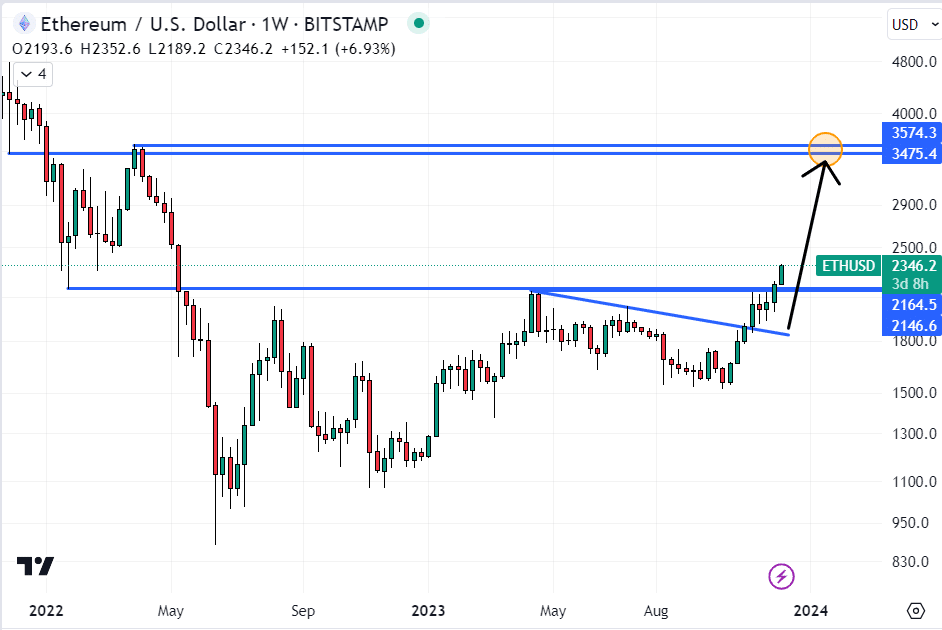

Worth Prediction – Can Ether (ETH) Attain $3,500 By December 31st?

ETH just lately broke above after which discovered sturdy help at key long-term resistance within the $2,150 space.

Chart evaluation exhibits that there aren’t many key resistance ranges now going all the way in which till 2022’s highs within the $3,500 space, that means fast potential upside of round 50% within the close to future.

Whether or not ETH might cowl such distance to the upside previous to the 31st of December (i.e. in simply over three weeks) appears unlikely however isn’t be remarkable in ETH’s value historical past.

In late July 2020, ETH rallied 57% in two week, adopted by a greater than 80% within the remaining week of 2020 and into the primary week of 2021.

The final week of April into the primary week of Could 2021 then noticed a greater than 70% acquire for ETH.

With technicals and fundamentals lining up at a usually sturdy time for the crypto market (i.e. a powerful chance of a santa rally), buyers shouldn’t wager towards ETH hitting $3,500 this 12 months.

Crypto Alternate options to Contemplate

Whereas ETH gives sturdy upside potential for the weeks forward, these seeking to diversify into another high-risk, high-reward funding technique ought to contemplate getting concerned in crypto presales.

That is the place buyers purchase the tokens of upstart crypto tasks to assist fund their growth.

These tokens are practically at all times bought cheaply, and there’s a lengthy historical past of presales delivering large exponential good points to early buyers.

Many of those tasks have implausible groups behind them and an amazing imaginative and prescient to ship a revolutionary crypto utility/platform.

If an investor can establish such tasks, the danger/reward of their presale funding is superb.

The group at Cryptonews spends quite a lot of time combing by presale tasks to assist buyers out.

Here’s a checklist of 15 of what the undertaking deems as one of the best crypto presales of 2023.

Disclosure: Crypto is a high-risk asset class. This text is supplied for informational functions and doesn’t represent funding recommendation. Through the use of this web site, you comply with our terms and conditions. We might utilise affiliate hyperlinks inside our content material, and obtain fee.

[ad_2]