[ad_1]

- Over the previous 24 hours, the crypto market has dipped by $14 billion, leading to $121 million value of lengthy liquidations.

- Ethereum, Dogecoin, PEPE, ApeCoin, and Compound, emerged as the highest 5 altcoins to watch extreme sudden liquidations.

- Whereas the precise cause for the liquidations is unknown, potential FUD surrounding the shutdown of Binance Join, the regulated buy-and-sell crypto arm of Binance, might be one.

To the shock of crypto merchants, the previous 24 hours turned out to be not precisely what one would take into consideration. Because the market reacted to the Binance-related news, it additionally doubtlessly led to an sudden change in sure cryptocurrencies’ value motion leading to thousands and thousands of {dollars} in liquidations.

Ethereum leads the liquidations race

Aside from Bitcoin, it was Ethereum that stood out because the altcoin with essentially the most liquidation. Being the second greatest cryptocurrency on the planet, it isn’t a shock, however the quantity of lengthy liquidations stood out from regular. Inside the previous day, over $15 million value of lengthy liquidations had been noticed within the case of ETH.

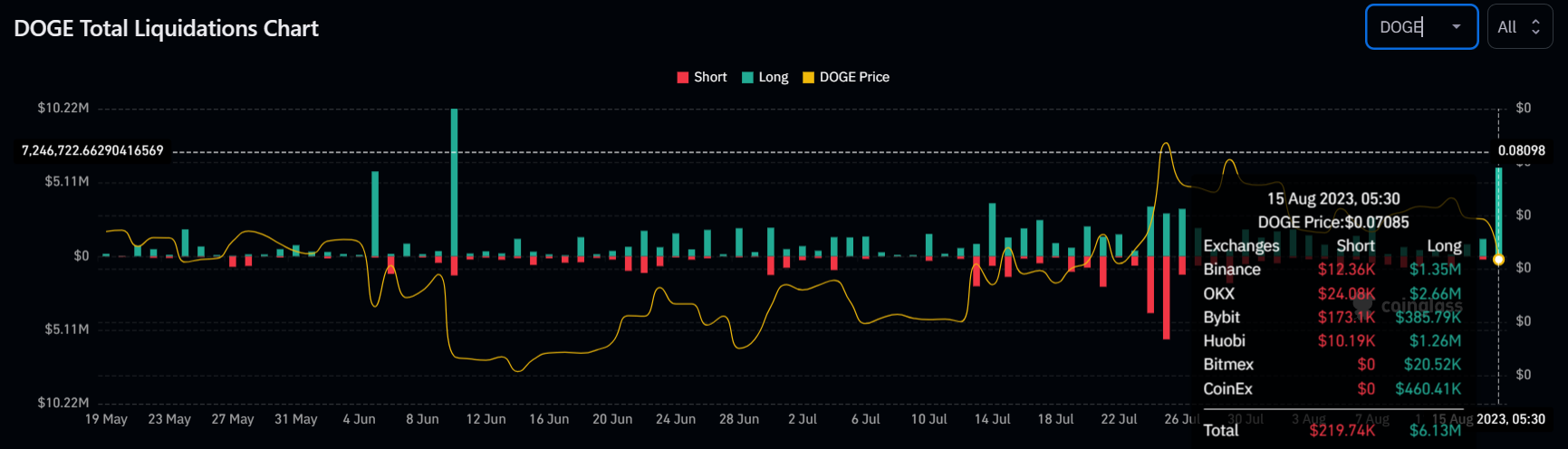

The opposite main cryptocurrencies that stood out on this regard had been Dogecoin, Pepe coin, ApeCoin and Compound. DOGE famous over $6.13 million value of lengthy liquidations, marking a two-month excessive, whereas the quantity of PEPE practically hit $1 million towards merely $80,000 value of brief liquidations.

Dogecoin lengthy liquidation

Equally, APE recorded about $1.44 million value of lengthy contracts being liquidated, hitting a month-to-month excessive, and COMP adopted in swimsuit, observing $809,000 in lengthy liquidations. Collectively, the crypto marketnoted over $121 million value of lengthy liquidations towards $10 million briefly liquidations inside a day.

ApeCoin lengthy liquidations

Whereas the precise cause behind that is unknown, the sudden shift in tone and liquidations is almost certainly a response to FUD. Earlier within the day, Binance’s regulated purchase and promote arm, Binance Join, was introduced to face closure. This was confirmed by Binance Good Chain-based decentralized trade Biswap that tweeted,

“After an intensive consideration, Binance has made a troublesome choice to disable Binance Join on 15 August on account of its supplier closing the supporting card funds service. This modification aligns with the strategic efforts of Binance to concentrate on its core companies.

Contemplating the worth motion response to the FUD, the crypto market misplaced about $14 billion in a day, dropping by 1.2% to hit a complete market capitalization of $1.12 trillion.

Open Curiosity, funding charge FAQs

Larger Open Curiosity is related to increased liquidity and new capital influx to the market. That is thought of the equal of improve in effectivity and the continued development continues. When Open Curiosity decreases, it’s thought of an indication of liquidation available in the market, traders are leaving and the general demand for an asset is on a decline, fueling a bearish sentiment amongst traders.

Funding charges bridge the distinction between spot costs and costs of futures contracts of an asset by rising liquidation dangers confronted by merchants. A persistently excessive and constructive funding charge implies there’s a bullish sentiment amongst market individuals and there may be an expectation of a value hike. A persistently unfavourable funding charge for an asset implies a bearish sentiment, indicating that merchants count on the cryptocurrency’s value to fall and a bearish development reversal is more likely to happen.

Like this text? Assist us with some suggestions by answering this survey:

[ad_2]