[ad_1]

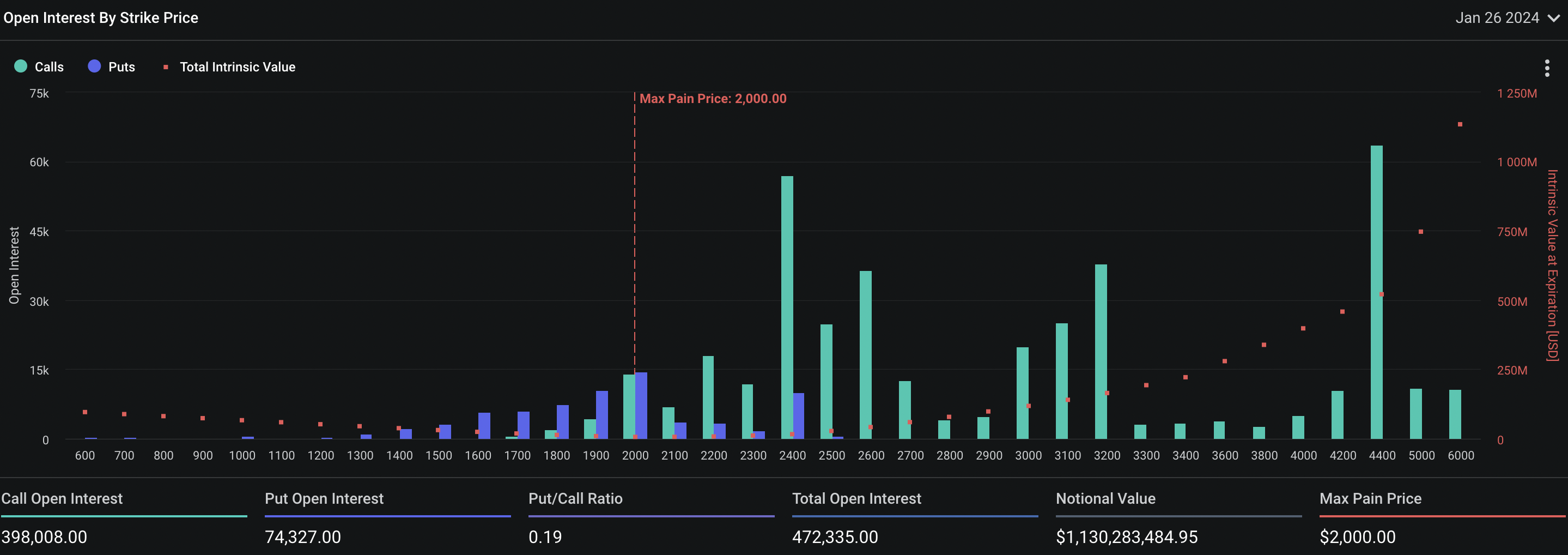

- Ethereum put/name ratio for choices expiring on January 26, 2024 is 0.19.

- ETH put/name ratio is 0.38, as on December 8, based on Deribit knowledge.

- Ethereum worth sustained above the $2,300 degree on Binance, because the altcoin printed almost 13% weekly positive aspects.

Ethereum, the second largest asset by market capitalization is on observe to rally in direction of its $2,500 goal within the ongoing cycle. Evaluating derivatives knowledge reveals a bullish bias amongst market contributors in January 2024.

Additionally learn: Solana price breaches key weekly resistance, SOL gains are likely sustainable

Ethereum derivatives merchants are bullish on ETH in 2024

Knowledge from Deribit reveals an underlying bullish bias amongst derivatives merchants, on Ethereum. The put/name ratio is taken into account an indicator of the temper amongst market contributors. It’s a contrarian indicator and it appears at choices buildup. Put/name ratio helps merchants perceive whether or not it’s time to make a contrarian name on an asset.

For Ether, the put/name ratio is 0.38 on December 8, as seen on Deribit. For choices contracts with January 26, 2024 expiry, the put/name ratio is 0.19. This rounds off to just about 2 places each 10 calls, a bullish bias amongst derivatives merchants.

Ethereum open curiosity by strike worth

For December 29 expiry, there are twice as many calls as places and this suggests Ethereum’s derivatives merchants are bullish on ETH worth rally by the tip of December. The altcoin is at present buying and selling at $2,359 on Binance. The altcoin has sustained above the $2,300 degree whereas Ethereum is in its uptrend. The altcoin has yielded almost 13% weekly positive aspects and upwards of 25% month-to-month positive aspects for merchants prior to now month. The altcoin’s commerce quantity has surged to $12.36 billion prior to now 24 hours.

[ad_2]