[ad_1]

Because the solar rose over Jackson Gap, Wyoming on Friday morning, all eyes have been on Federal Reserve Chairman Jerome Powell.

In his keynote speech on the Kansas Metropolis Fed’s Symposium, Powell famous that charges will stay excessive till inflation sufficiently slows.

Oh, and don’t rule out additional fee will increase sooner or later, both.

In the event that they suppose it’s applicable, they’ll do it — fastidiously, in fact.

Whereas Wall Road had its predictable jitters this week main as much as the speech. And the crypto market appeared to reply in sort, with Bitcoin sliding roughly 10% in per week.

Within the meantime, there was loads of motion within the realm of cryptocurrency over the previous week. So strap in as we break down the week’s crypto information. Let’s get began!

🥇 Coinbase Breaks New Floor

Coinbase (Nasdaq: COIN) has lastly clinched the inexperienced mild to checklist crypto futures within the U.S., a big transfer that’s been within the works for practically two years. Approval to function as a Futures Fee Service provider (FCM) was granted by the Nationwide Futures Affiliation (NFA). For these not within the know, FCMs play a pivotal position in shopping for or promoting futures contracts, form of like market makers.

This approval units Coinbase aside because the inaugural crypto-centric platform within the U.S. to supply regulated and leveraged crypto futures alongside its conventional spot buying and selling choices. The larger image? Andrew Sears, CEO of Coinbase Monetary Markets, put it finest, stating that offering U.S. traders with entry to safe and controlled crypto futures is a game-changer. Following the announcement, shares of COIN opened 4% greater. (The inventory has greater than doubled this 12 months after hitting all-time lows following the collapse of FTX.)

🛍️ Shopify + Solana = Energy Transfer

This week, e-commerce titan Shopify (Nasdaq: SHOP) announced that it will combine Solana Pay, permitting retailers on its platform to simply accept fee with cryptocurrency.

For starters, funds will probably be made through USDC, which these of you who tuned in final week know is a stablecoin tied to the U.S. greenback. For individuals who didn’t, right here’s the quick model: USDC is the second-largest stablecoin, regulators are warming as much as it, and it guarantees to supply the soundness of the U.S. greenback throughout the crypto ecosystem (all explanation why it’s changing into a best choice for each retailers and customers).

Solana is a high-performance blockchain recognized for its environment friendly decentralized functions and sensible contracts. And if all the things goes based on plan, this partnership will supply a cheap different to conventional fee strategies. Transaction charges will probably be a fraction of a penny and settle practically immediately — in comparison with bank card processing charges, which might value as excessive as 3.5% and take as much as two days to settle.

Not solely might it result in value financial savings for companies, but it surely might additionally assist with the innovation of crypto-based loyalty schemes, like NFT rewards.

Why This Issues

Add all of it up, and this can be a fairly huge deal. Shopify is liable for a whopping 10% of the U.S. e-commerce market. It’s beforehand dabbled in crypto, however this latest transfer with Solana might be a game-changer, probably driving wider crypto adoption and setting the stage for extra mainstream crypto-based transactions.

Pantera Makes A METAL Bitcoin Prediction 🎸🤘

No, Pantera isn’t releasing a brand new album (though that may be superior). The legendary metallic band shares a reputation with Pantera Capital, a number one blockchain funding agency. And this week, they made a daring prediction:

Bitcoin might hit $148,000 by July 2025.

Contemplating BTC lately closed a hair above $26,000, that sounds bonkers, proper? However contemplate this…

The forecast is predicated on the historic affect of Bitcoin’s “halving” occasions. For these not within the loop, a “halving” is like Bitcoin’s model of a inventory cut up, however with a twist.

As we’ve coated up to now, Bitcoin mining entails receiving a reward (within the type of BTC) for validating new transactions on the blockchain. Nicely, each 4 years, the rewards miners obtain are lower in half. (Get it?)

Now, consider there’ll solely ever be 21 million Bitcoins. As of now, about 18.8 million have been mined, leaving a restricted provide to be mined. This shortage is a part of what offers Bitcoin its worth.

This “halving” successfully reduces the speed at which new Bitcoins are created and launched into circulation. Traditionally, these halving occasions have led to vital value surges because of the diminished provide of recent cash.

Pantera’s prediction considers the subsequent halving occasion, anticipated in 2024, and the following provide squeeze. Right here’s the juicy part:

“The subsequent halving is predicted to happen on April 20, 2024. Since most bitcoins are actually in circulation, every halving will probably be virtually precisely half as huge a discount in new provide. If historical past have been to repeat itself, the subsequent halving would see bitcoin rising to $35k earlier than the halving and $148k after.”

Supply: Pantera Capital

One other Bearish Technical Signal For Bitcoin 📉🐻

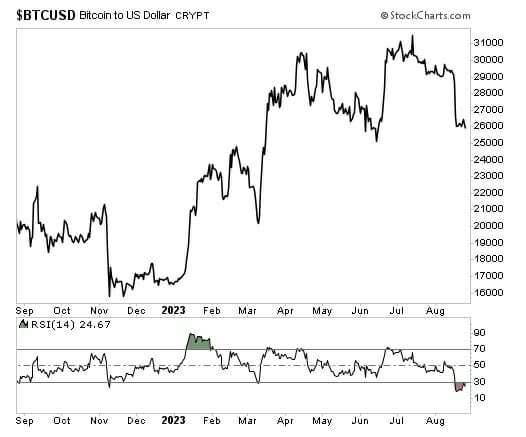

Alex Kuptsikevich, a senior market analyst at FxPro, noted that Bitcoin’s development seems decidedly bearish. The cryptocurrency lately dipped beneath its 200-week and 200-day transferring averages, signaling a possible shift to a bearish development. (Presently, Bitcoin was buying and selling round $26,000.)

And if that weren’t sufficient, one other key technical indicator exhibits that Bitcoin is experiencing probably the most excessive oversold situations because the COVID-19 market crash in March 2020.

I’m speaking in regards to the relative power index (RSI). This momentum indicator gauges an asset’s latest value motion relative to its common over a set interval (sometimes 14 days). Deciphering RSI is fairly easy — a studying above 70 signifies an “overbought” situation, whereas a studying beneath 30 signifies “oversold.”

After final week’s crypto “flash crash” and this week’s continued softness, Bitcoin’s RSI has plummeted nicely beneath 30. It’s necessary to notice that an “overbought” or “oversold” situation can stay that manner for some time, but it surely means that Bitcoin’s value has fallen too quickly.

Because the adage goes, it’s all the time darkest earlier than the daybreak.

Crypto Tip of the Week: HODL, Defined

For those who’re new to the crytpo world, you’ve in all probability observed that there’s a good bit of slang that will get thrown round. One time period you could have seen is “HODL”.

Initially derived from a misspelling of the phrase “maintain,” this has change into one of the crucial in style phrases within the cryptocurrency neighborhood. It basically means to carry on to a cryptocurrency somewhat than promoting. The time period originated from a 2013 publish on the BitcoinTalk discussion board by a consumer named GameKyuubi, who wrote, “I AM HODLING” throughout a tough day within the crypto markets. The typo caught on and have become a meme throughout the neighborhood.

Over time, HODL has developed into an acronym for “Maintain On for Pricey Life.”

It represents a mentality the place a person believes within the potential of a cryptocurrency, no matter its present market volatility. HODLers are sometimes not swayed by short-term value drops or surges. They maintain their holdings with the expectation of potential future beneficial properties.

In essence, when somebody says they’re “HODLing,” they’re expressing their dedication to a zero-sum mentality (“moon or nothing”).

P.S. Need to know extra about our favourite methods to put money into crypto — and methods to do it? You have to see this…

Our group thinks a choose few cryptos are about to go on one other monster run. And we simply launched a bombshell briefing about how one can revenue. Go here now to learn more…

This text initially appeared on StreetAuthority.com.

[ad_2]