[ad_1]

- Chainlink has rolled outs its much-anticipated airdrop, with distribution based mostly on on-chain exercise.

- As much as $20 million has been allotted for the airdrop, which is out there for certified L2 Ethereum customers.

- LINK value has succumbed to promoting stress, falling 5% as airdrop holders look to dump

Chainlink (LINK) value is buying and selling with a bearish inclination, having misplaced all the bottom coated in the course of the August 29 rally that was fueled by the Grayscale asset supervisor’s resounding victory in its longstanding case in opposition to the US Securities and Change Fee (SEC).

Additionally Learn: Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Investors resort to small collections amid dull markets

Chainlink value drops as $20 million airdrop commences

Chainlink (LINK) value has shed roughly 5% of its worth, shifting from the $6.318 intra-day excessive recorded on Tuesday. The hunch may be attributed to the community’s $20 million airdrop, which has impressed a dump amongst airdrop token holders.

Lastly! Chainlink JUST launched INSANE Airdrop which nearly ANYONE can get! That is how https://t.co/9XFQS48VGf Chainlink is open-source know-how that’s collectively developed by a big neighborhood of builders, researchers, and customers who share the aim of constructing…

— 周婷婷 (@mico_tin631002) August 30, 2023

The airdrop is out there for Ethereum Layer-2 (L2) customers that meet the necessities. It’s a means for the community to reward the LINK neighborhood, whereas on the identical time incentivizing participation within the community.

Chainlink has earned its place among the many go-to networks for decentralized finance (DeFi) builders and tasks. The recognition attributes to its distinctive capacity to hyperlink sensible contracts to off-chain knowledge sources. The airdrop is well timed, coming at a time when the market is craving volatility. With merchants searching for actionable value strikes for a fast revenue amid a lull market, the sell-off offers futures merchants an avenue for revenue.

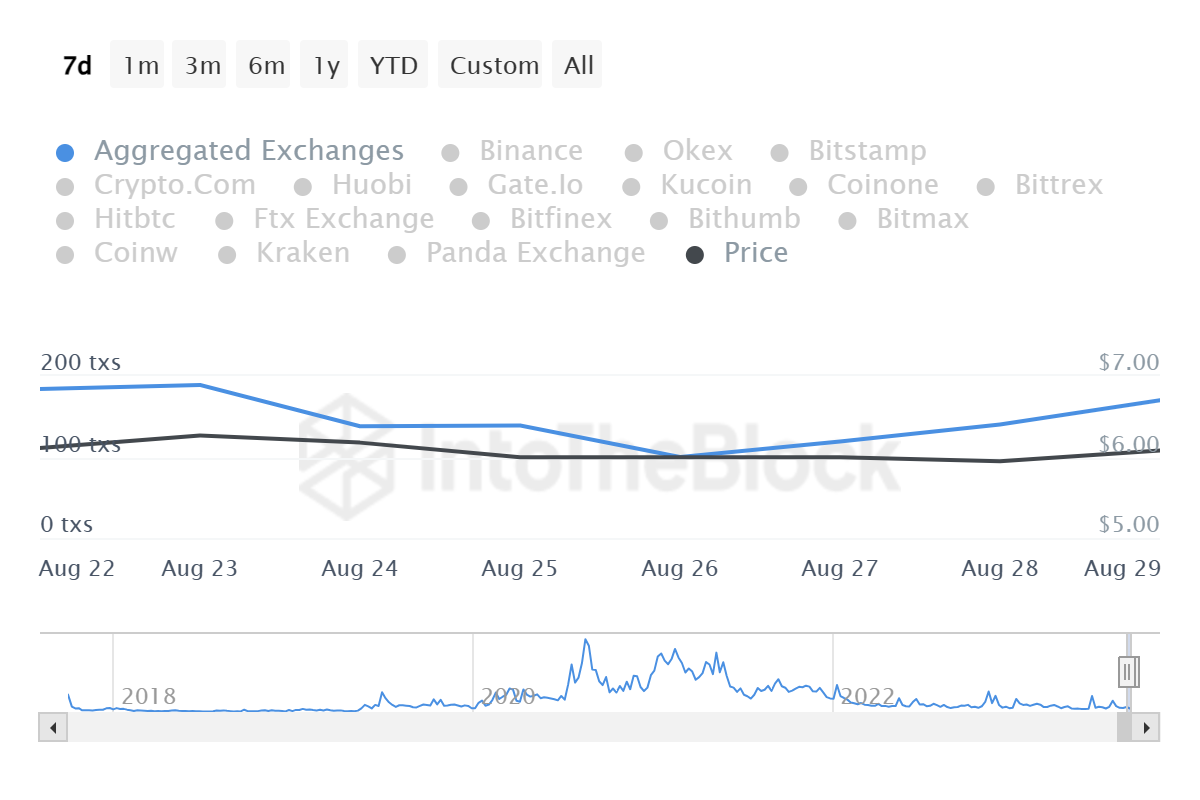

Knowledge from IntoTheBlock exhibits that inflows into exchanges have been on a gentle rise since August 26, suggesting intention to promote as buyers sought to keep away from the worth drop.

LINK inflows into exchanges

LINK value forecast amid growing promoting stress

On the time of writing, Chainlink value is at $5.907 whereas figuring out the subsequent transfer. Momentum indicators such because the Relative Power Index (RSI) and the Superior Oscillator favor the draw back, which means LINK may proceed south, doubtlessly dropping the $5.808 assist degree earlier than dipping into the demand zone at $5.407.

Contemplating a requirement zone is characterised by aggressive shopping for, Chainlink value may bounce from this order block. Nonetheless, if it fails to carry as a assist degree, the altcoin may break beneath the assist flooring at $5.020.

LINK/USDT 1-day chart

Conversely, buyers leveraging the hunch to purchase the dip may ship Chainlink price north, presumably clearing the $6.609 barricade for an opportunity to check the availability zone at $7.103. LINK may additionally appropriate round this zone, the place aggressive sellers abound. Nonetheless, if it fails to carry as a resistance degree, an extension north may guarantee, confirmed by a decisive each day candlestick shut above $7.637.

In a extremely bullish case, Chainlink value could extrapolate to the $8.144 provider congestion zone, ranges final seen in late July. This may point out a 5% ascension in opposition to what would then be a bullish breaker.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the biggest cryptocurrency by market capitalization, a digital forex designed to function cash. This type of cost can’t be managed by anybody individual, group, or entity, which eliminates the necessity for third-party participation throughout monetary transactions.

Altcoins are any cryptocurrency aside from Bitcoin, however some additionally regard Ethereum as a non-altcoin as a result of it’s from these two cryptocurrencies that forking occurs. If that is true, then Litecoin is the primary altcoin, forked from the Bitcoin protocol and, subsequently, an “improved” model of it.

Stablecoins are cryptocurrencies designed to have a steady value, with their worth backed by a reserve of the asset it represents. To attain this, the worth of anybody stablecoin is pegged to a commodity or monetary instrument, such because the US Greenback (USD), with its provide regulated by an algorithm or demand. The primary aim of stablecoins is to supply an on/off-ramp for buyers keen to commerce and spend money on cryptocurrencies. Stablecoins additionally permit buyers to retailer worth since cryptocurrencies, on the whole, are topic to volatility.

Bitcoin dominance is the ratio of Bitcoin’s market capitalization to the entire market capitalization of all cryptocurrencies mixed. It offers a transparent image of Bitcoin’s curiosity amongst buyers. A excessive BTC dominance sometimes occurs earlier than and through a bull run, during which buyers resort to investing in comparatively steady and excessive market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance normally signifies that buyers are shifting their capital and/or earnings to altcoins in a quest for increased returns, which normally triggers an explosion of altcoin rallies.

[ad_2]