[ad_1]

Disclosure: The views and opinions expressed right here belong solely to the writer and don’t symbolize the views and opinions of crypto.information’ editorial.

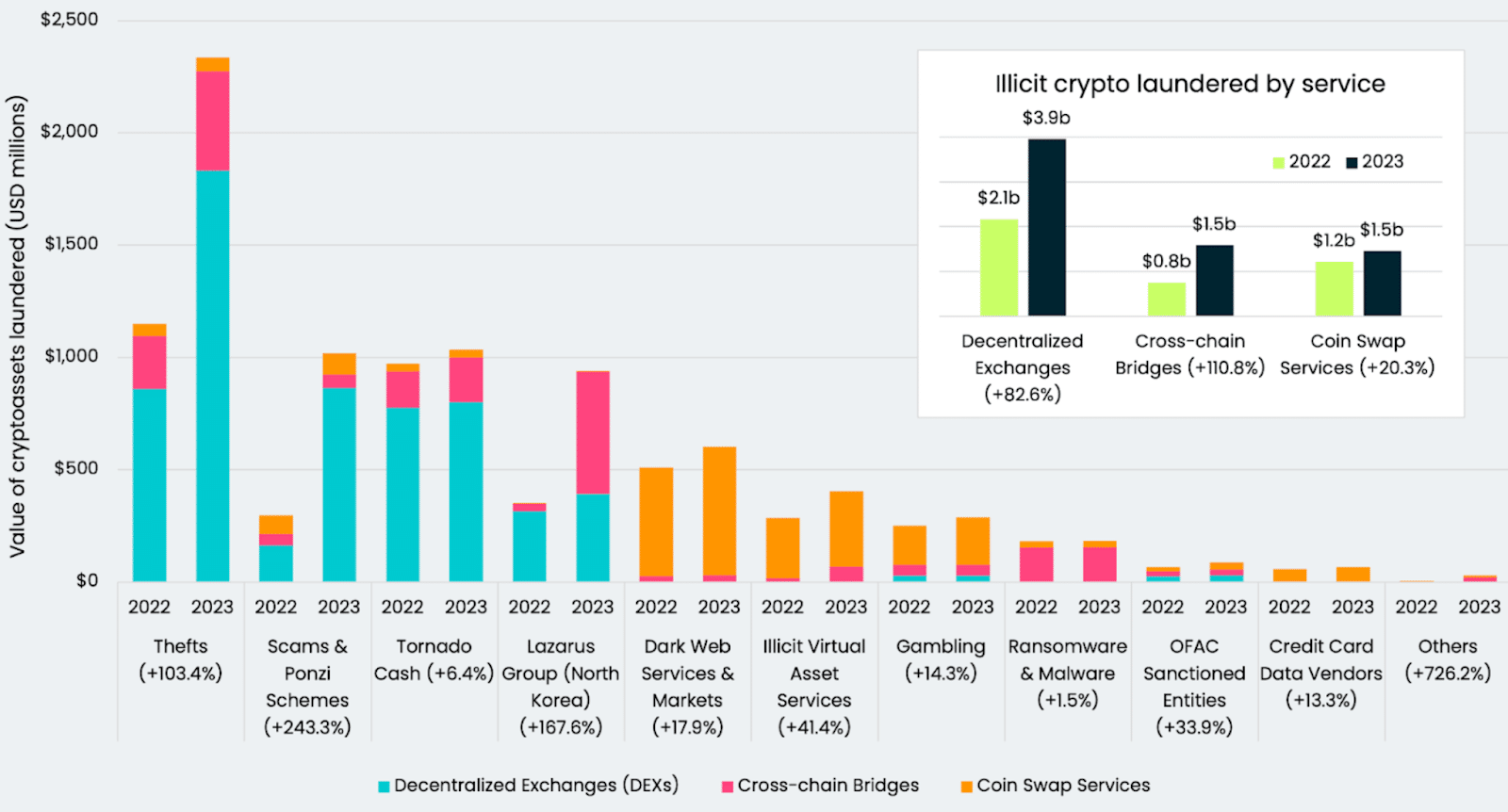

A latest landmark report from Elliptic revealed an eye-popping $7 billion in illicit crypto property has been laundered by way of cross-chain providers. What does that truly imply? Basically, felony organizations are using decentralized exchanges, cross-chain bridges, and coin-swapping providers to cowl up the tracks and origins of funds from unlawful sources.

Seven billion of US {dollars} is a worrisome determine and exposes a transparent blind spot in stamping out cash laundering by way of loopholes and processes in decentralized monetary frameworks. And if we take Elliptic’s report at face worth, it additionally alerts that illicit actors have moved on from crypto mixers to make use of bridges as a bona fide software for cash laundering and different monetary crimes.

The state of cross-chain crime by predicate offense and repair used | Supply: Elliptic

We will both settle for or ignore that bridges are getting used for these functions and chalk it as much as being a reality of life in defi. However that method doesn’t remedy any issues in squashing crypto cash laundering—it solely sweeps it underneath the rug.

It’s not as if these instruments are constructed with felony exercise in thoughts. If something, they embody crypto’s basic tenets of preserving privateness and streamlining transactions by eradicating the purple tape. Nonetheless, their misuse in fostering illicit transactions and unlawful fund transfers reveals how a benevolent service can turn into weaponized.

For example, based mostly on how cross-chain bridges inherently operate, it’s straightforward for criminals to maneuver funds from a well known tackle on one chain to a model new tackle on the second chain, severing the data chain as they please. The switch course of both wraps the funds or removes them from pooled liquidity, rendering them successfully untraceable. The bridge successfully acts as a getaway automobile.

We’ve seen this narrative of misuse play out a number of instances in crypto even past mixers, with crypto exchanges as soon as being a hotbed for cash laundering and monetary crime. Very like exchanges 5-10 years in the past, there’s no form of ‘passport management’ for these bridges. When you might say that it is a section that bridges will section out of very similar to centralized exchanges finally did, their use as a cash laundering channel to such an excessive can’t be ignored.

So how can this rampant abuse of crypto’s infrastructure get reined in?

Proper now, probably the most vital blind spot for crypto crimes on cross-chain bridges stems from a definite lack of anti-money laundering (AML) protocols inside their frameworks. Whereas some chains attempt to retain the data chain that connects the 2 networks collectively by not permitting customers to specify a special vacation spot tackle, that solely works when each blockchains are EVM-based. Even then, their performance and scope are restricted to the detection intelligence on the vacation spot blockchain—permitting illicit actions to nonetheless slip by way of the cracks.

The standard response right here can be to say that bridges should go in the wrong way of how they function now. Put in intensive KYC and AML measures to forestall cash laundering or different monetary crimes and the issue’s solved—even when it means having to endure KYC controls to bridge $20 in property and create an costly, cumbersome, and unfriendly UX.

However there’s one other manner that’s rooted in buffing up AML practices. Whereas KYC and AML usually do go hand-in-hand, they’re not the identical factor and don’t operate in the identical manner. Sure, there’s an overlap, however conflating the 2 as being interchangeable is inaccurate.

Cross-chain bridges can nonetheless operate anonymously or pseudonymously whereas nonetheless implementing AML guardrails that don’t explicitly contain heavy KYC obstacles. The purpose isn’t to reveal everybody to bridging any asset, however simply to make sure that cash being transferred between chains isn’t being finished by a bootleg pressure that simply stole it and desires authorities to lose monitor of it. However that can take just a few modifications to completely notice.

A seemingly easy resolution to cease cash laundering in its tracks can be for regulators to cross mandates dictating AML parameters that bridges should meet to function. However everyone knows that attaining regulatory readability for blockchain merchandise is something however easy—and permitting exploitation to occur within the meantime solely worsens regulatory attitudes.

From a technical perspective, that might contain instituting some stage of permission into bridging infrastructure and implementing some type of anomaly detection that isn’t so invasive. Preserving trustlessness and privateness as a lot as doable whereas nonetheless stopping monetary crimes is definitely possible.

Technical options, then, are solely as much as the bridge’s builders to implement. However since most bridges are applied as decentralized protocols, and with out a mandate to pressure them into doing so, most initiatives don’t see the necessity to implement any AML measures. Whereas that perspective is extremely short-sighted, it does replicate the fact of cross-chain providers not eager to step on the toes of decentralization purists or alienate their viewers by introducing extra steps into the transaction course of.

That method has to alter shortly. Builders ought to take the steps essential to implement technical options and controls to instill AML capabilities into their frameworks as all actions happen on-chain. Whereas which may ring the alarms of builders who don’t need to add one other middleman or purple tape into defi, that’s not essentially the case.

Since blockchain exercise might be embedded beneath a number of composability layers, protocols should implement an answer that operates on the coronary heart of the place it takes place. Meaning implementing real-time on-chain AML protocols. That comes within the type of sanctions, fraud detection, and prevention checkpoints or encouraging on-chain transparency for any transactions or exercise. Being proactive in creating deterrence measures for illicit actions will solely assist a protocol stay credible in the long term whereas conserving its customers secure.

If blockchain and crypto as a complete are to be adopted on a large scale, making certain that its frameworks should not getting used to fund terror, oppressive regimes, or unlawful companies on the expense of different customers turns into paramount. Sure, you could possibly argue that cash laundering nonetheless occurs within the conventional monetary business and this could solely assist put a band-aid on a wider challenge. However placing stress on bridges and different cross-chain providers to intensify their AML and fraud prevention practices in the end advantages everybody and helps crypto reside as much as its full potential as an intermediary-free monetary ecosystem.

[ad_2]