[ad_1]

In case you ever see me, in any discussion board, recommending that folks can buy crypto, then one among two issues has occurred. Both somebody has created a deep pretend of me, or I’ve been kidnapped. Within the latter situation, “purchase crypto” could be my secret misery sign. Name the cops.

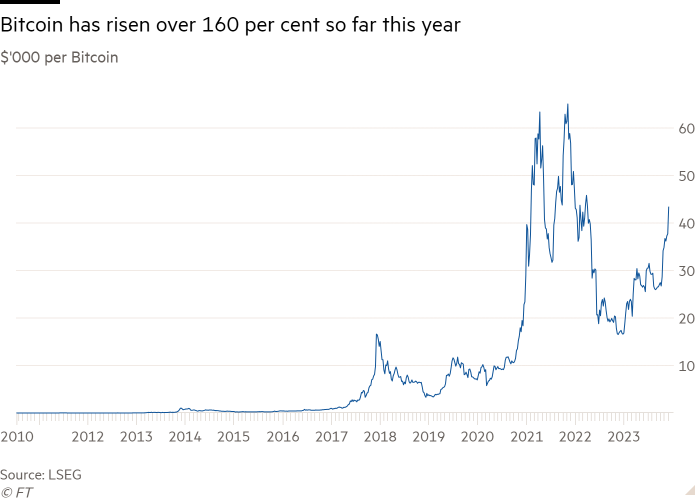

Nonetheless, it’s onerous to disregard the startling rally in bitcoin. Belief me, I’ve tried. Someway, regardless of a swirling hellfire of regulatory aggression and authorized strife afflicting a number of of the important thing establishments on this house, the worth of this token has risen by 160 per cent this 12 months (not a typo) to $44,000, in a rally that has accelerated sharply over the previous week or so. That comfortably eclipses any conventional asset class on the planet.

To be clear, if folks wish to purchase these tokens, I bear them no ailing. Individuals spend cash on Crocs sandals, actual ale and different issues I don’t like on a regular basis. Equally, taking a punt on a crypto token is simply as legitimate as shopping for a lottery ticket or placing a fiver every manner on the 1.40 at Kempton racecourse. Nothing unsuitable with that. If you wish to do that, knock your self out. I hope it makes you wealthy. If it does, the final giggle shall be yours, so please don’t trouble sending the same old all-caps emails telling me I’m an fool — they’ll simply go within the file with the others.

Nonetheless, what are the circumstances underneath which this works as an funding technique? What does the worth rise actually imply? When the asset class is, say, shares or bonds, buyers have broadly agreed metrics and assumptions to reply these questions. However that is bitcoin. Strap in for a dizzying train of partially wise however largely round arguments that a lot of cheap folks sincerely consider.

Zach Pandl is a type of folks, who left a profession in macro technique at Goldman Sachs for a task as an analyst at Grayscale, which operates crypto funding trusts. “I consider in the way forward for this,” he says. However on the similar time, “I’m not an ideological particular person right here”.

Pandl usually appears to be like on the worth of crypto tokens by means of the identical lens as main currencies, that are broadly (and I stress broadly) decided by actual rates of interest and fund flows. Pandl reckons bitcoin’s newest violent ascent is admittedly all the way down to the US Federal Reserve and the idea it’s performed elevating charges and will even lower them soonish. “Gold has seen that, bonds have seen that, and bitcoin has seen that,” he says. Up to now so believable: the very massive drop we have now seen in bond yields just lately boosts the relative attract of non-yielding belongings like gold and crypto. However for Pandl, that is about extra than simply that.

As an alternative, he says bitcoin is the one “apparent competitor foreign money” within the occasion that the US greenback is “debased”. The euro, sterling, yen and renminbi don’t, for him, move the check. This requires you consider two issues: that greenback debasement can be a factor, and that it may be changed in its central function because the world’s reserve foreign money by a token you can not but use to purchase a cup of espresso. It’s a stretch.

Other than rates of interest, one other key short-term set off usually cited for bitcoin’s newest rally is that the manifold well-publicised failures of crypto initiatives over the previous 12 months, and specifically final month’s $4.3bn fine on Binance, may have been worse. My thought right here is “aside from that, Mrs Lincoln, how was the play?” However for these crypto proponents who usually are not in jail, the very fact Binance nonetheless exists in any respect is a constructive.

The massive one although is investor demand. I’m but to fulfill a single chief funding officer or portfolio supervisor at any institutional cash supervisor who has any curiosity in bitcoin. Boosters insist bitcoin is bringing in this type of cash, however past just a few hedge funds, enterprise capital companies and household places of work, the proof for that is scant at greatest. Rich people are most likely conscious of bitcoin’s newest leap, however even there, sector advisers are sceptical. “I’m not seeing extra demand from the consumer facet,” mentioned Christian Nolting, chief funding officer at Deutsche Financial institution Wealth Administration. “I’ve sufficient volatility on the bonds facet, I don’t want crypto for the vol,” he mentioned.

It’s potential that if US regulators approve the launch of money bitcoin change traded funds by establishments equivalent to BlackRock, that may tempt extra buyers to hunt publicity to crypto by means of them. This might, probably, actually be a breakthrough second however the true demand is but to be seen and it may already be priced in.

That is simply one of many contradictory arguments right here, although. On the similar time, we’re informed crypto is up as a result of sovereign residents wish to keep away from authorities and regulatory intrusion, and it’s up as a result of it might be about to achieve higher regulatory oversight. It’s apparently concurrently a wager on inflation falling, and a hedge in opposition to inflation rising. It’s a foreign money, but additionally a speculative asset.

This stuff can’t all be true on the similar time. The actual fact is, completely different folks purchase crypto for all of those completely different causes and extra, contradictions be damned. The one factor the newest worth rise tells you is that an unknown variety of individuals are shopping for this illiquid token extra enthusiastically than they have been earlier than. Quantity go up.

[ad_2]