[ad_1]

Bitcoin (BTC) and Ethereum (ETH) have been cruising alongside the market, with their costs staying above $23,000 and $1,500 respectively. This has contributed to an total development of the worldwide crypto market cap which at present stands at $1.05 trillion, exhibiting a 0.91% enhance within the final 24 hours.

Regardless of this, merchants look like reluctant to make any vital affords forward of the US Federal Reserve’s announcement. This text will concentrate on Bitcoin costs and Ethereum prediction, in addition to the present US Federal Open Market Committee (FOMC) and Fed fee at present.

Because the starting of this 12 months, the cryptocurrency markets have been steady and flashing inexperienced, which might be attributed to the Federal Reserve’s potential dovish stance.

A deal signed by DekaBank with Metaco to start offering digital belongings to establishments can have a big impression on the crypto market, along with the upcoming Federal Reserve rate of interest hike.

FOMC and Fed Fund Price Forward

The US greenback had weakened initially of the buying and selling session as a result of knowledge suggesting that wage pressures had decreased, nonetheless, it later stabilized as buyers anticipated the outcomes of a Federal Reserve coverage assembly.

The USA Federal Reserve is prone to enhance rates of interest by 0.25% on Wednesday, nonetheless, merchants shall be extra targeted on the press convention of Chairman Jerome Powell for clues concerning their long-term stance towards coverage change.

Regardless of this, the greenback index, which gauges the worth of the greenback towards six different main currencies, slipped 0.029% to 102.060. The market skilled a 0.16% dip within the final buying and selling session, partly due to the information that US labor prices had risen on the slowest fee in a 12 months in the course of the fourth quarter.

Traders shall be retaining a detailed eye on the choices of the European Central Bank and the Bank of England this week. Each are prone to increase rates of interest by 0.5% on Thursday, so buyers ought to ensure that they keep up-to-date with these financial occasions.

The fixed depreciation of the US greenback was additionally seen as an vital factor that maintained elevated cryptocurrency costs.

German Financial institution to Present Crypto Providers

DekaBank, a 105-year-old financial institution with $428 billion in belongings, has agreed to collaborate with Metaco to start promoting digital belongings to establishments. In response to a January 31 press launch, DekaBank will use Metaco’s Harmonize, a platform for “custody and orchestration.”

The custody platform is extraordinarily vital for DekaBank and due to this fact, its announcement had a huge effect on the cryptocurrency trade together with Bitcoin. Metaco will be capable of monitor all digital asset operations via this platform which is why the information was so vital.

Explaining The Current Threat-On Wave In Crypto Markets

The worldwide cryptocurrency market has maintained its bullish development and gained extra bids across the $1.05 trillion mark as a result of the truth that $117 million, the best quantity since July of final 12 months, was invested in crypto-based funding merchandise between January 21 and 27.

Moreover, the optimistic bulletins concerning cryptocurrency laws additionally had a big impression on the crypto market sentiment. Shifting ahead, buyers look like cautious about inserting a powerful bid till the Federal Reserve coverage assembly has concluded.

Bitcoin Value

As of at present, Bitcoin worth is at $22,993.90 with a 24-hour buying and selling quantity of $22b. It has elevated by 0.25% previously 24 hours, inserting its place at 1st on the CoinMarketCap rankings with a market capitalization of $443b.

On the 4-hour timeframe, Bitcoin is buying and selling with no clear bias because the market awaits the Federal Open Market Committee and Federal Reserve fee choices. Nonetheless, the rapid resistance for the BTC/USD pair stays on the $23,300 stage, and a breakout above this stage has the potential to take the BTC/USD pair towards the subsequent resistance space of $23,920.

The main technical indicators, such because the RSI and MACD, are in a promote zone, and the 50-day easy transferring common can also be suggesting a promoting development.

On the draw back, an upward trendline is prone to help Bitcoin at $22,750, and a bearish breakout of this stage may create extra room for promoting till $22,350.

Ethereum Value

Ethereum has seen a worth of $1,572.48 at present with a buying and selling quantity of $6.2 billion inside the final 24 hours. It has skilled a 0.03% lower in worth since then and at present holds rank 2 on CoinMarketCap with a market cap of $192 billion.

Technical evaluation means that Ethereum may expertise a bullish reversal as soon as it reaches the double-bottom help stage of $1,540. Challenges stay on the upside as there may be excessive resistance across the $1,600 mark. If it overcomes this impediment, ETH may surge to across the $1,625 stage.

If help on the $1,540 stage fails, it may open up an additional decline in worth till the $1,500 mark.

Bitcoin Alternate options

CryptoNews Business Speak has evaluated the highest 15 cryptocurrencies for 2023. Should you’re on the lookout for a extra promising funding alternative, there are different options to think about.

Each week, new altcoins and ICO initiatives are added to the listing.

Disclaimer: The Business Speak part options insights by crypto trade gamers and isn’t part of the editorial content material of Cryptonews.com.

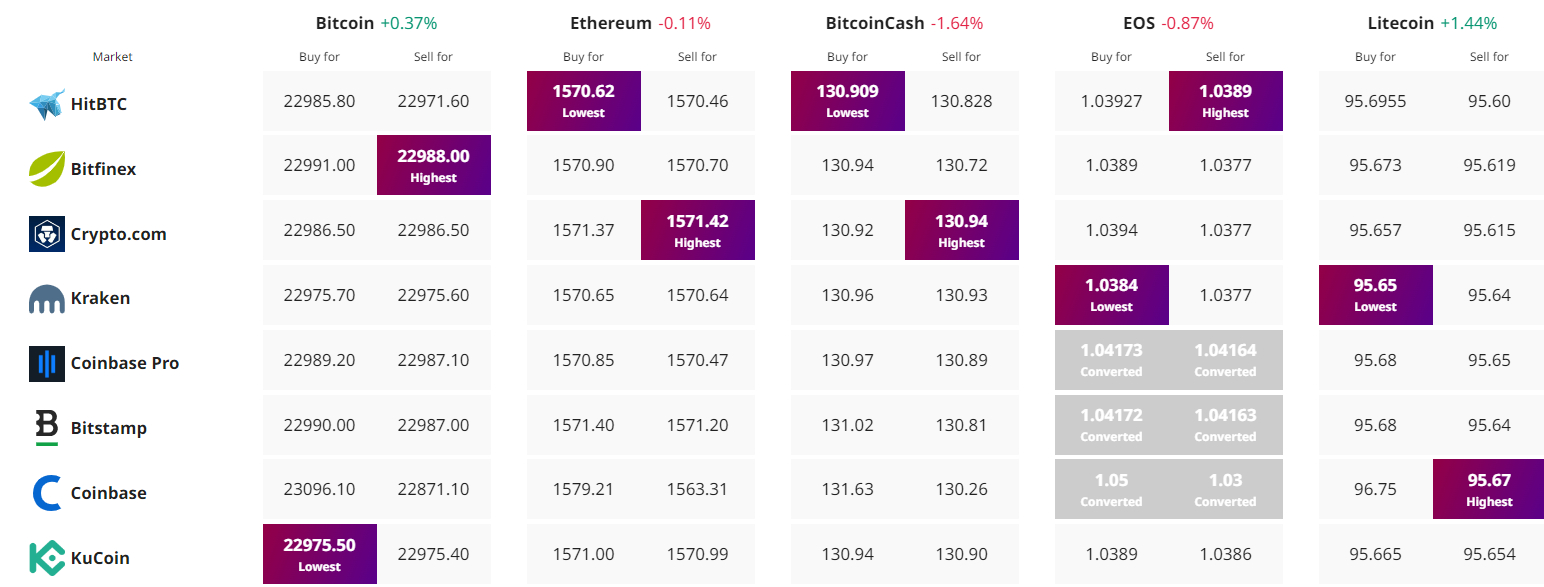

Discover The Finest Value to Purchase/Promote Cryptocurrency

[ad_2]