[ad_1]

Bitcoin and Ethereum costs have been regular regardless of experiencing vital volatility previously few weeks. Bitcoin is sustaining a slim vary between $22,350 and $23,350, whereas Ethereum is buying and selling choppily inside a good vary of $1,550 to $1,630.

As we enter the weekend, many traders are questioning if this may very well be the time for a breakout.

The reply to this query lies within the evaluation of Bitcoin and Ethereum costs over latest days. By trying on the historic tendencies of those two main cryptocurrencies, traders can get an thought of whether or not or not this weekend might see BTC & ETH escape from their present ranges.

Moreover, by understanding the underlying elements that affect Bitcoin and Ethereum costs, traders could make knowledgeable selections about their investments.

Cryptocurrency Market Overview: The Fundamentals Of An Upcoming Growth

A cryptocurrency bullish rally was sparked by the beforehand launched Private Consumption Expenditures (PCE) report, which confirmed a slowdown in inflation on the finish of final yr.

Consequently, merchants count on the FOMC to boost rates of interest by 25 foundation factors (or 0.25 share factors) at its February assembly. If the Fed maintains its hawkish stance, Bitcoin (BTC-USD) might undergo.

The latest US inflation print, then again, served as a affirmation sign for traders to purchase Bitcoin and different cryptocurrencies.

Moreover, elevated institutional traders in the US have been liable for rising Bitcoin costs.

New York Introduces Groundbreaking Laws To Enable Crypto Funds

Since early 2023, there have been quite a few developments within the cryptocurrency area which were serving to to help and drive the crypto market. On twenty sixth January, the New York State Senate launched a invoice permitting authorities institutions to just accept cryptocurrency as an official type of cost.

This might assist additional legitimize using digital currencies in mainstream commerce.

If New York Meeting Invoice 2532 is handed and turns into legislation, cryptocurrencies can be accepted as cost below sure situations, which can profit the cryptocurrency sector in the long term. It must also be famous that this invoice doesn’t seem to help the industrial use of cryptocurrencies.

Alternatively, the present laws can be amended to permit state businesses to make use of cryptocurrencies.

Nevertheless, the invoice specifies Bitcoin Money, Ethereum, Litecoin, and Bitcoin as acceptable currencies. The invoice was written by Assemblyman Clyde Vanel, who has additionally proposed laws on cryptocurrency fraud and the formation of trade job forces.

Wendy Rogers Introduces Payments To Make Bitcoin Authorized Tender In The US

Senator Wendy Rogers from Arizona is making her mark within the US Senate by introducing numerous payments on cryptocurrencies. Her work is bringing about a number of cryptocurrency-related modifications and making a optimistic influence on the state of Arizona.

You will need to acknowledge the efforts of Senator Wendy Rogers who has been actively concerned in issuing bitcoin banknotes. Rogers talked about a research by Goldman Sachs which revealed that Bitcoin is probably the most worthwhile asset on this planet, no matter geographical area. This knowledge signifies that Bitcoin has emerged as the highest performer globally.

The US is considering on the potential of formally recognizing Bitcoin (BTC) as a authorized tender. If this proposal is profitable, it’ll open up new alternatives for cryptocurrency and will result in an exponential surge in its worth.

Increased US Greenback May Cap Achieve In BTC

The broad-based US greenback has been flashing inexperienced and has risen from eight-month lows as expectations for a Federal Reserve-engineered financial comfortable touchdown and a pause in its aggressive financial tightening subsequent week have grown in response to slowing inflation knowledge.

Based on a report from the Commerce Division, client spending in the US declined for 2 consecutive months in December.

The report additionally confirmed the smallest improve in private revenue in eight months, largely on account of average wage progress – although not essentially optimistic indicators for inflation.

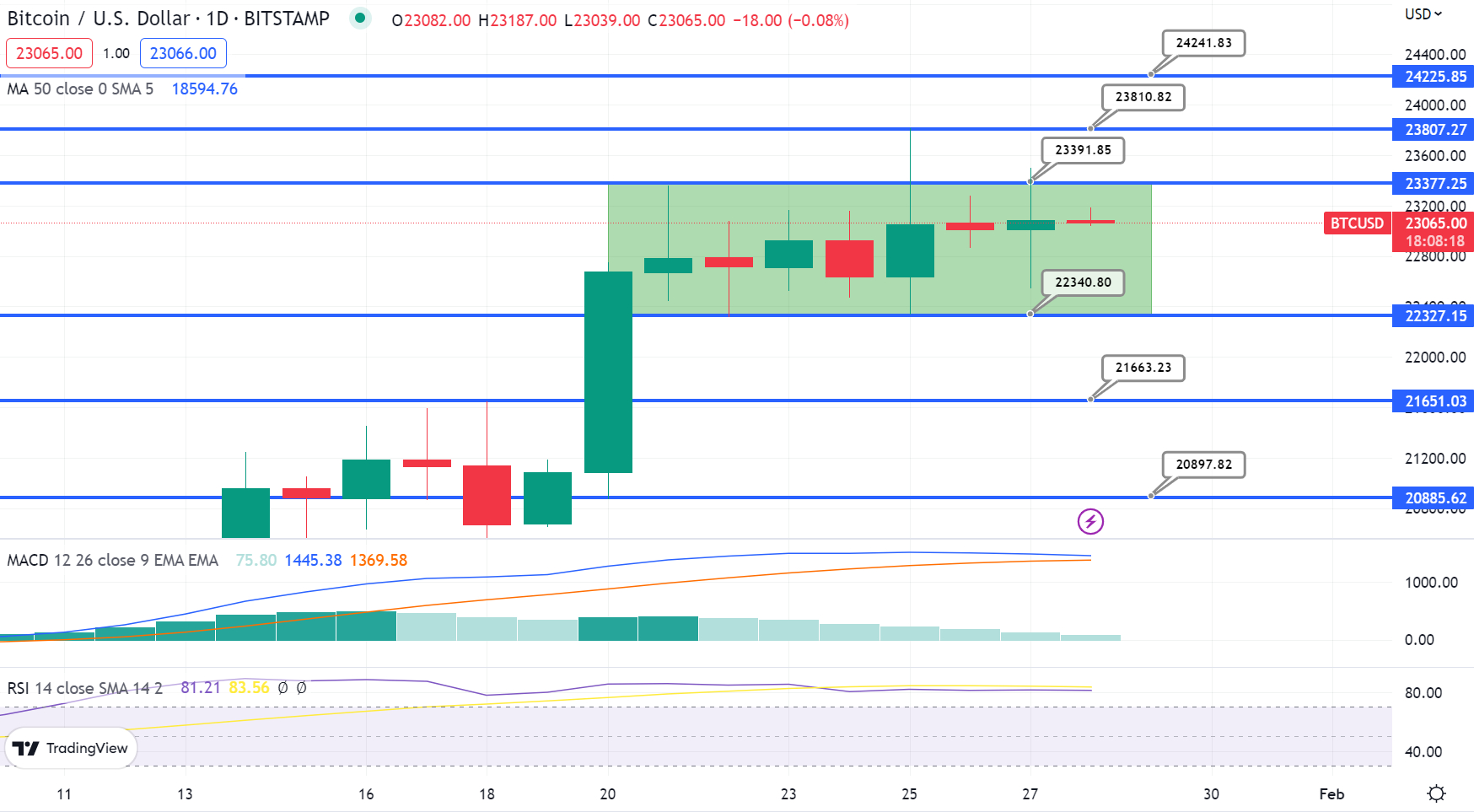

Bitcoin Value

Bitcoin is at present valued at $23,004, with a 24-hour buying and selling quantity of $22 billion. Within the final 24 hours, Bitcoin has been uneven, up lower than 0.50%. With a dwell market price of $435 billion, CoinMarketCap at present ranks prime.

Bitcoin is at present encountering resistance on the $23,250 degree, with instant help remaining steady at $22,500. If the value of Bitcoin falls beneath $22,500, a bearish market development is probably going, and it might attain as little as $21,500. If it continues to fall from there and reaches $20,450, we may even see an much more bearish development.

The Relative Energy Index and the Shifting Common Convergence Divergence are each overbought. Nonetheless, a bullish engulfing candle was just lately noticed, suggesting that the bullish market development will proceed.

Bitcoin’s instant resistance degree is at $23,250; if it breaks above this value level, it might transfer as excessive as $23,900 and $25,150.

Ethereum Value

Ethereum is at present buying and selling at $1,595 and has skilled a 1.5% lower previously 24 hours with a complete buying and selling quantity of $6 billion. It is ranked 2nd on CoinMarketCap, with a dwell market capitalization of $195 billion.

Within the 4-hour timeframe, the ETH/USD pair fell sharply from the $1,600 degree. This drop was brought on by a break in an upward channel and a subsequent shut beneath this value level. The downward development finally resulted in a backside at $1,525 per share.

At $1,600, Ethereum might encounter resistance. If it might probably break by this barrier, its value may rise to $1,675. Alternatively, there’s a probability of a bearish development starting at $1,525 that may lengthen to $1,445 if it does break down.

Bitcoin Alternate options

CryptoNews Trade Discuss has reviewed the highest 15 cryptocurrencies for 2023. Should you’re in search of a better potential funding alternative, there are many different initiatives price contemplating.

The listing is up to date weekly with new altcoins and ICO initiatives.

Disclaimer: The Trade Discuss part options insights by crypto trade gamers and isn’t part of the editorial content material of Cryptonews.com.

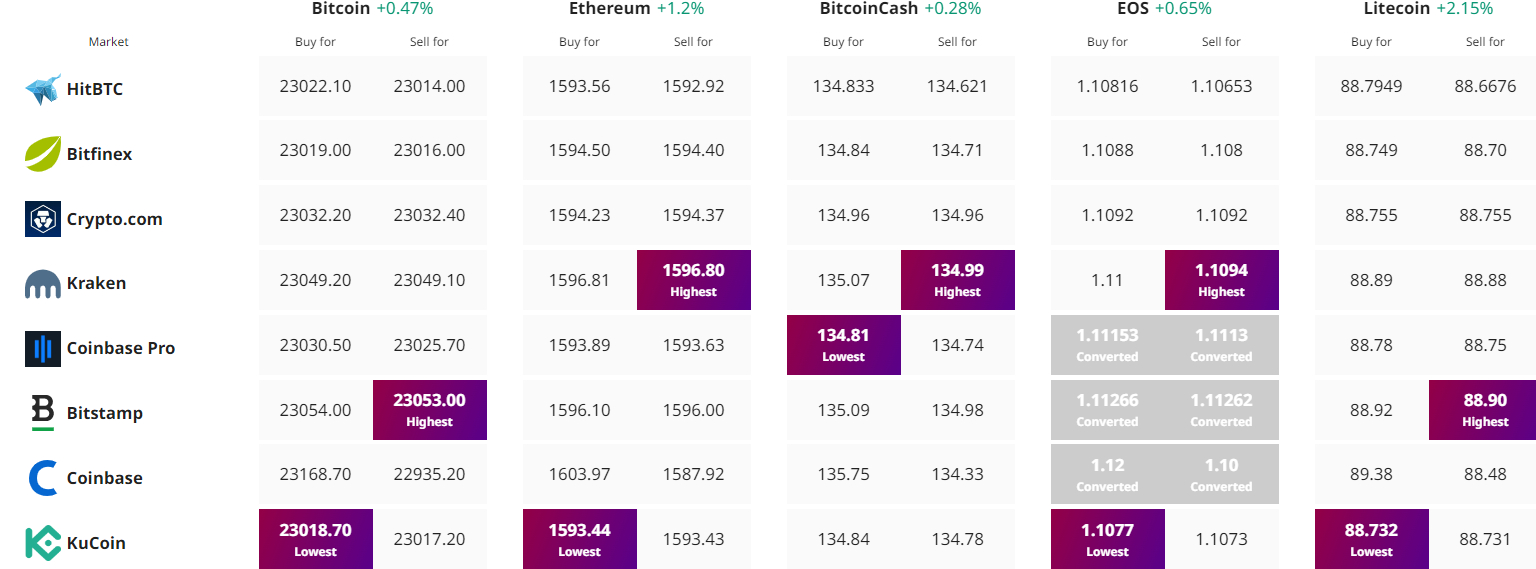

Discover The Greatest Value to Purchase/Promote Cryptocurrency

[ad_2]