[ad_1]

Bitcoin (BTC-USD) and different high cryptocurrencies have surged in 2023. The Bitwise Crypto Industry Innovators ETF (NYSEARCA:BITQ) has benefited from this renewed crypto momentum, because the ETF has almost tripled year-to-date. Whereas it has given its buyers nice returns this yr, these trying to kick the tires now after this achieve ought to concentrate on a number of necessary elements earlier than investing choice.

What Does the BITQ ETF Do?

Launched in Might of 2021, BITQ is an ETF from Bitwise that invests in its underlying Bitwise Crypto Innovators 30 Index. Bitwise’s objective is to offer buyers direct publicity to the “picks and shovels” firms which are “constructing out the core infrastructure that lets crypto thrive, together with Bitcoin miners, crypto brokerages, and extra,” in line with Bitwise. The ETF offers buyers a pure-play approach to spend money on these crypto firms, allocating at the very least 85% of its funds into them and rebalancing on a quarterly foundation.

Thoughts the Excessive Bills

Whereas BITQ might certainly give buyers pure-play publicity to an thrilling and fast-growing sector of the financial system, one factor that buyers ought to concentrate on is BITQ’s conspicuously excessive expense ratio, which stands out even amongst different crypto ETFs, that are identified for prime bills. With an expense ratio of 0.85%, buyers in BITQ pays $85 in charges on a $10,000 funding.

You might be considering that this doesn’t sound so dangerous — however remember the fact that these charges compound over time. After three years, assuming that the payment stays fixed and that the fund positive factors 5% per yr going ahead, the identical investor may have paid $271 in charges, and after 5 years, they may have paid $471. Over the course of 10 years, this investor may have coughed up a whopping $1,049 in charges, or greater than 10% of their preliminary funding. It’s exhausting to construct up a portfolio if you end up sacrificing that a lot in charges.

Portfolio Composition

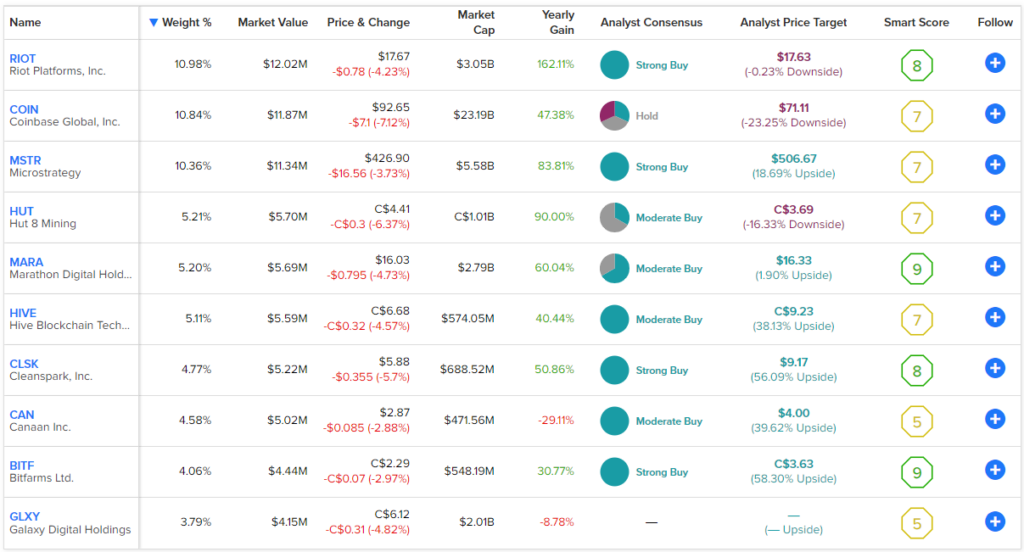

Along with this excessive expense ratio, one other factor that buyers ought to concentrate on is that BITQ isn’t notably diversified. It holds simply 27 shares, and its high 10 holdings account for 65.6% of its property. Under, you’ll be able to check out an outline of BITQ’s top 10 holdings utilizing TipRanks’ holdings instrument.

In equity to BITQ, it’s a directional guess on the trajectory of the crypto trade, so broad diversification isn’t a high precedence as it could be with a broad-market fund. Nonetheless, it is rather concentrated towards its high positions.

Bitcoin miner Riot Platforms (NASDAQ:RIOT), main publicly-traded crypto brokerage and trade Coinbase World (NASDAQ:COIN), and enterprise software program firm MicroStrategy (NASDAQ:MSTR) — which holds a substantial quantity of Bitcoin on its steadiness sheet — all have weightings of 10% or extra.

Moreover, the fund is dominated by crypto miners like Riot Platforms, Hut 8 Mining (NASDAQ:HUT), and Marathon Digital (NASDAQ:MARA). There may be nothing mistaken with investing in Bitcoin miners themselves, and these firms will be nice bets on the worth motion of Bitcoin.

A few of these miners function robust Good Scores. For instance, high holding Riot Platforms, plus Marathon Digital, Cleanspark (NASDAQ:CLSK), and Bitfarms (NASDAQ:BITF), all function Outperform-equivalent Good Scores of 8 or above.

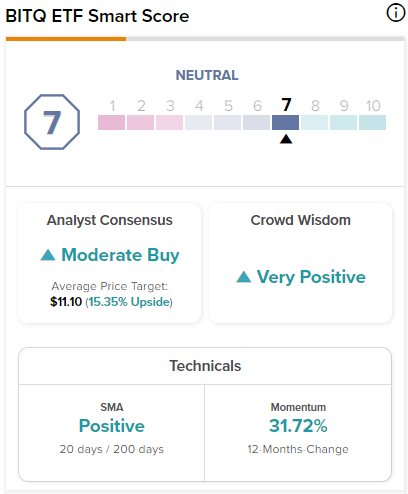

The Smart Score is a proprietary quantitative inventory scoring system created by TipRanks. It offers shares a rating from 1 to 10 primarily based on eight market key elements. A rating of 8 or above is equal to an Outperform score. BITQ has a Impartial ETF Good Rating of seven.

Nonetheless, miners make up nearly half of BITQ’s property, and these shares largely commerce in tandem with one another, following the worth motion of Bitcoin (often with extra pronounced strikes to the upside and draw back than Bitcoin itself), so proudly owning so lots of them isn’t actually including a lot in the way in which of differentiation or diversification.

To BITQ’s credit score, it does look past the everyday crypto names like miners plus Coinbase and MicroStrategy for its portfolio. It owns fee community giants Visa (NYSE:V) and Mastercard (NYSE:MA), which have labored to spend money on blockchain expertise and discover integrating it into their very own enterprise fashions.

BITQ additionally owns CME Group (NASDAQ:CME) (previously often called the Chicago Mercantile Alternate), which facilitates the buying and selling of Bitcoin and Ethereum (ETH-USD) futures and choices contracts (as properly Micro Bitcoin and Micro Ethereum futures and choices).

Different fascinating picks embody Interactive Brokers (NASDAQ:IBKR), which permits purchasers to purchase Bitcoin, Ethereum, Bitcoin Money (BCH-USD), and Litecoin (LTC-USD) on its platform, in addition to Latin America’s e-commerce chief MercadoLibre (NASDAQ:MELI), which has experimented with its personal crypto token that can be utilized on its platform.

Financial institution of New York Melon (NYSE:BK) is within the ETF as properly. It’s one in every of America’s oldest banks and the world’s largest custodial financial institution, nevertheless it has just lately ventured into digital asset custody providers for its clientele. Lastly, fintech gamers like PayPal (NASDAQ:PYPL) and Block (NYSE:SQ) provide loads of crypto publicity in their very own proper.

These are all fascinating holdings, however sadly, they’re all comparatively minor holdings for BITQ, as all have weightings of 1-2%. I personally would have favored to see BITQ focus extra on a few of these multifaceted crypto members that provide various kinds of publicity to the crypto trade and maybe pare again on a number of the miners.

Is BITQ Inventory a Purchase, In line with Analysts?

Turning to Wall Road, BITQ has a Reasonable Purchase consensus score, as 73.36% of analyst rankings are Buys, 21.03% are Holds, and 5.61% are Sells. At $11.10, the average BITQ stock price target implies 15.7% upside potential.

Conclusion

Whereas I agree with BITQ that cryptocurrency is an trade that provides the potential for prime development and excessive revenue margins, its excessive charges and relative lack of diversification take away from its attraction as an funding alternative.

Moreover, whereas the ETF has put up a monster 196% return year-to-date, buyers ought to notice that even after this achieve, it was nonetheless down 40% since inception as of the top of the June quarter.

[ad_2]