[ad_1]

Bitcoin and Ethereum have been two of the preferred digital property on this planet, with their costs having seen an enormous surge since their inception. As an increasing number of folks turn out to be fascinated about cryptocurrencies, you will need to perceive what elements might propel Bitcoin and Ethereum to new heights.

This text will talk about the varied elements that might have an effect on the costs of those two widespread digital currencies, together with elementary and technical evaluation.

Up to now 24 hours, the crypto market cap has elevated by 1.45% to a staggering $1.71 trillion whereas buying and selling quantity has gone down by 7.81%, amounting to $79.382 billion.

DeFi’s market share within the 24-hour cryptocurrency buying and selling quantity was round 0.01% with a complete of $9.84 billion. Nonetheless, stablecoins represented 99.99% at $79.82 billion and Bitcoin had a 41.65% market dominance on the time of writing, buying and selling at $37,527.19 at this time.

The Components That Might Propel BTC and ETH To New Heights

Within the upcoming week, crypto buyers will watch the US Fed Fund Charge and US Nonfarm Payroll figures intently.

US Fed Fund Charge & FOMC

February 1st marks a busy week for central banks because the Federal Open Market Committee (FOMC), Financial institution of England (BOE), and European Central Financial institution (ECB) all collect to announce their respective Curiosity Charge Choices.

The CME FedWatch Instrument predicts a excessive chance (98%) of the Federal Open Market Committee mountaineering rates of interest by 25 foundation factors and setting the goal vary for the federal funds price at 4.75%.

The troublesome choice to make is whether or not the central banks will ship a dovish or much less hawkish price hike. Financial efficiency since December has been under expectations as seen by retail gross sales and manufacturing knowledge. Moreover, inflation elements have been weaker than standard.

Common Hourly Earnings skilled a substantial lower whereas the Client Value Index (CPI) for December marked its first adverse studying since Might 2020. Central bankers have been lively over the previous month and most of them are predicting a 0.25% price hike this week and probably one other 0.25% enhance in March.

Is it attainable that the FOMC might point out a 0.25% price rise this week, but determine to take a pause to evaluation the cumulative hikes just like what the Financial institution of Canada did?

The choice on the speed of returns for cryptocurrencies may have a major affect on their worth motion out there.

US Nonfarm Payroll Figures

The US nonfarm payroll figures present a sign of the energy of the economic system by monitoring whole employment exterior the farm sector. This knowledge is utilized by merchants to make selections about when to purchase or promote cryptocurrencies and different digital property. The present uneven session within the crypto market can shift to a risky market upon the discharge of US NFP figures subsequent week.

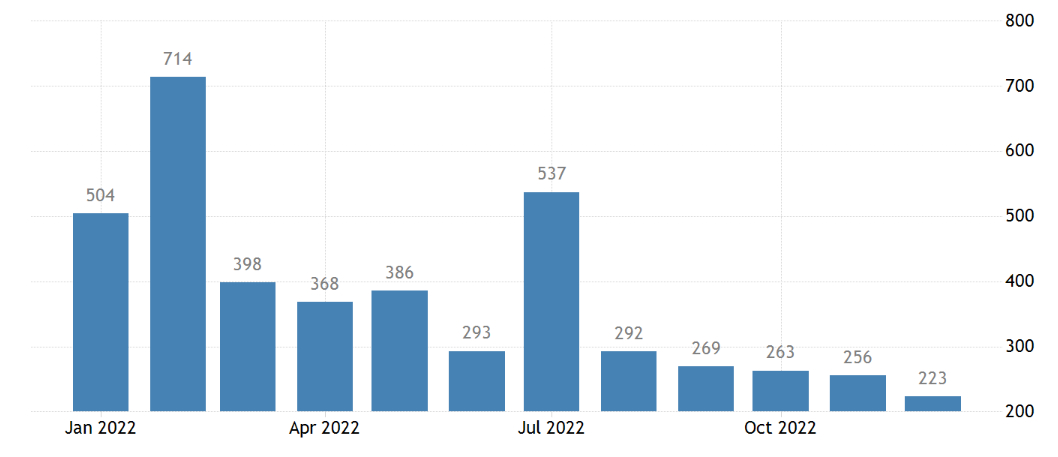

After a downwardly corrected 256K enhance in November and topping market forecasts of 200K, the US economic system added 223K jobs in December 2022, the least since December 2020. Will increase in payroll employment totaled 4.5 million in 2022, or a mean of 375 thousand per 30 days, in comparison with 562 thousand in 2021 and 168 thousand in 2019.

The labor market is steadily returning to regular following the shock of the epidemic, and the report exhibits that hiring is slowing down, albeit it’s nonetheless robust.

In line with Fed projections, the labor market will proceed to be tight in 2023, however job creation will stall and the unemployment price will climb to 4.6%.

Amid rising rates of interest, sluggish shopper demand, and a worldwide financial slowdown, many massive know-how firms have already introduced main layoffs.

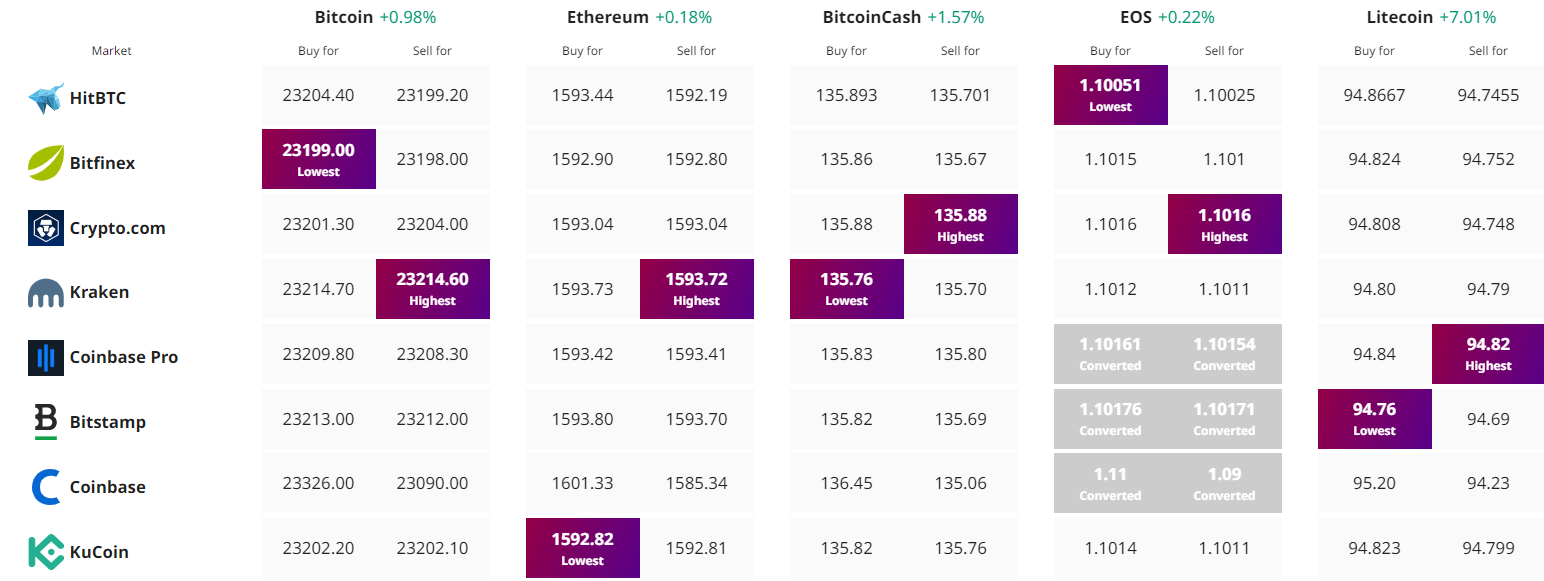

Bitcoin Value

As of at this time, the present Bitcoin worth is round $23,223 & its 24-hour buying and selling quantity is round $17 billion. In line with CoinMarketCap, it has a market cap of $447 billion and occupies the first spot. There is a circulating provide of 19,275,881 BTC cash with a most provide of 21 million BTC cash.

The technical outlook of Bitcoin has not modified considerably lately because the BTC/USD continues to commerce in a slim vary between $22,900 and $23,400. If Bitcoin’s value dips under $22,900, the market will be anticipated to tackle a bearish pattern, probably sinking as far down as $22,400.

If it continues to fall to $21,750, we might even see an much more bearish pattern.

In the intervening time, Bitcoin’s instant resistance degree is about at $23,250. If it manages to surpass that time, the cryptocurrency could attain a excessive of $23,900 and even $25,150.

Ethereum Value

Ethereum is at present buying and selling at $1,593 and has skilled a 0.50% enhance previously 24 hours with a complete buying and selling quantity of $6.8 billion. It is ranked 2nd on CoinMarketCap, with a stay market capitalization of $195 billion.

Over the course of 4 hours, ETH/USD has been buying and selling choppily, holding just under $1,600. Closing candles beneath this degree has robust odds of accelerating downward stress on Ethereum. Moreover, Ethereum has fashioned a symmetrical triangle sample, which is indicating indecision amongst buyers.

On the decrease aspect, assist is current at $1,560, and a break under this degree could lead on ETH towards $1,500. Conversely, a bullish break above the $1,625 degree might ship ETH towards the $1,680 mark.

Bitcoin Alternate options

The highest 15 cryptocurrencies for 2023 have been assessed by CryptoNews Trade Discuss. There are many different initiatives value investigating in the event you’re looking for a greater potential funding alternative.

New altcoins and ICO initiatives are added to the listing on a weekly foundation.

Disclaimer: The Trade Discuss part options insights by crypto business gamers and isn’t part of the editorial content material of Cryptonews.com.

Discover The Finest Value to Purchase/Promote Cryptocurrency

[ad_2]