[ad_1]

Axie Infinity price is at the helm of its recovery after exploding another 29% in 24 hours to trade at $12.86 at the time of writing. The NFT and gaming token extended the current green candle’s wick to $14.00, a price level that was seen last in September. It is plausible that the uptrend is just beginning and taking advantage of the push from the Chinese New Year.

It has become a norm for cryptocurrency prices to rally during the Lunar New Year (Chinese New Year). This year’s celebrations took place on January 22, based on the Lunar Calendar. During this time, over-the-counter (OTC) services are usually closed – a situation that escalates to an extremely volatile crypto market.

Axie Infinity Price Relentlessly Pushing To $20

Axie Infinity price needs a controlled hold above higher support, preferably above $12.00. This will pave the way for other macro and fundamental factors to catch up with the price momentum. Furthermore, it is the best way for AXS to prevent sudden distractive pullbacks likely to be caused by overhead pressure from a panic-selling wave to book early profits.

A buy signal from the Moving Average Convergence Divergence (MACD) indicator adds credence to the bullish outlook, which hints at a continuing uptrend. Investors seem convinced Axie Infinity price will keep the impetus intact.

There is a higher influx of funds into AXS markets as shown by the position of the Money Flow Index (MFI) at 76.09. This indicator resembles the Relative Strength Index (RSI) but tracks the volume to gauge the momentum of the trend. With the MFI rising into the overbought region, the path with the least resistance will likely stick to the upside.

Traders wishing to join the party now must wait for Axie infinity to confirm the uptrend before firing up their buy orders. It is worth noting that a retracement to $12.00, or even $10.00 will allow many sidelined investors to buy AXS ahead of the next move to $20.00.

Therefore, new buy orders may be placed above $10.00 if not $12.00 for an initial profit booking at the 200-day Exponential Moving Average (EMA) at $14.51. Stubbornly bullish traders may want to wait for $20.00 before cashing out.

Fundamentals Improve, Backing the Bullish Outlook in Axie Infinity Price

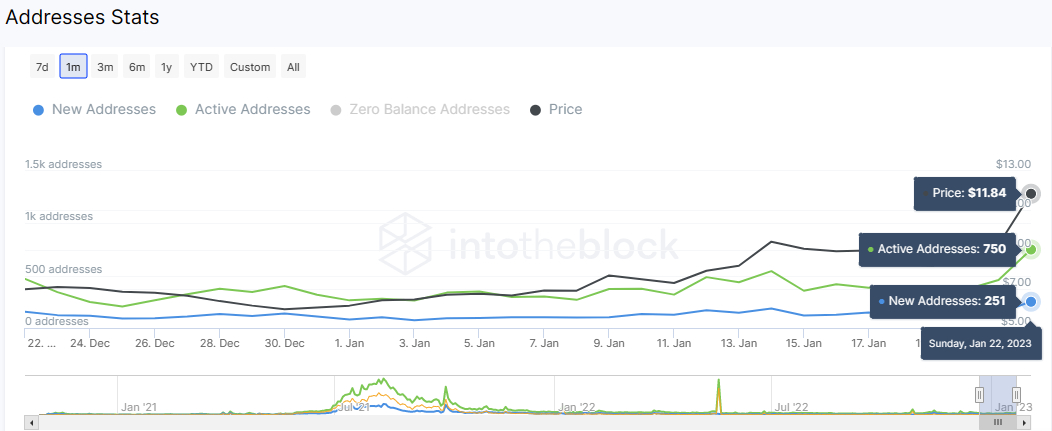

The number of new addresses joining the Axie Infinity network has over the last three weeks ticked up to 251 from January 1’s 85. According to IntoTheBlock, a similar growth pattern was reflected by daily active addresses currently at 750 from 264 in the same period.

The price has been increasing in tandem with these metrics, which means they positively influence AXS. In other words, Axie Infinity price is expected to continue climbing, as long as new and active daily addresses uphold the momentum.

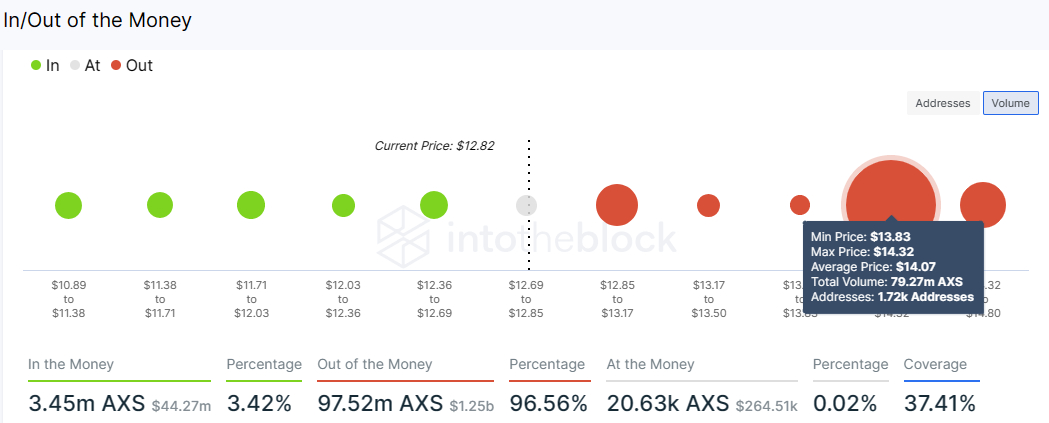

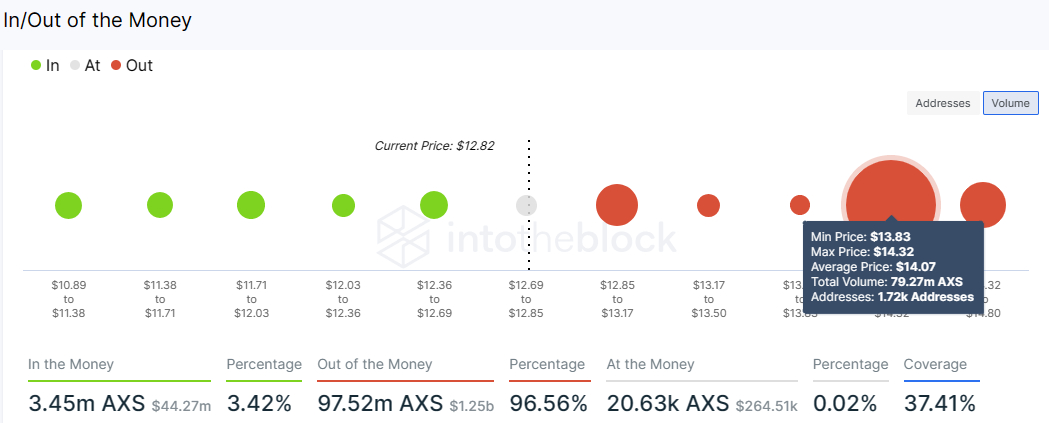

Investors should consider locking in the gains if insight from IntoTheBlock’s IOMAP model is considered. This model groups addresses in clusters depending on the price at which they bought AXS tokens in the past.

For example, the region between $13.83 and $14.32 is home to 1,720 addresses that purchased 79.27 million AXS. As Axie Infinity’s price recovers, investors within this range will likely sell at various breakeven points which might stifle growth and lead to declines. Hence, the need for investors to tread cautiously while awaiting a possible move to $20.00.

Axie Infinity alternatives

If you’re looking for other high-potential crypto projects alongside AXS, we’ve reviewed the top 15 cryptocurrencies for 2023, as analyzed by the CryptoNews Industry Talk team.

The list is updated weekly with new altcoins and ICO projects.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

Related Articles:

- XRP Price Prediction as Ripple Lawsuit Set to Conclude in 2023 – Can XRP Reach $10 if Ripple Wins the Case?

- Can Ethereum Price Holding Above $1,600 Open Road to $2,000 in Week Ahead

- Best Crypto to Buy Today 21st January – APTOS, MEMAG, OP, FGHT, HBAR, CCHG, SOL, RIA, MANA, TARO, D2T

[ad_2]