[ad_1]

- Ripple was defeated by Polkadot, which emerged because the foremost crypto asset banks are uncovered to.

- The Basel Committee on Banking Supervision report, made up of 19 banks, famous $10.2 billion price of crypto asset publicity.

- XRP value has been on a downtrend for the reason that starting of the month and is near dropping the important thing help of $0.600.

XRP value is near dropping the income the altcoin witnessed within the first week of November. One of many greatest catalysts with regards to value motion is the use circumstances of Ripple and XRP amongst banks, in addition to their publicity to this altcoin. Nonetheless, by the appears of it, Ripple has misplaced that crown to Polkadot.

Ripple loses to Polkadot

Ripple, in response to a latest report from The Basel Committee on Banking Supervision (BCBS), has been eclipsed by Polkadot. The Committee is a financial institution regulation authority with about 45 high banks throughout the globe as members.

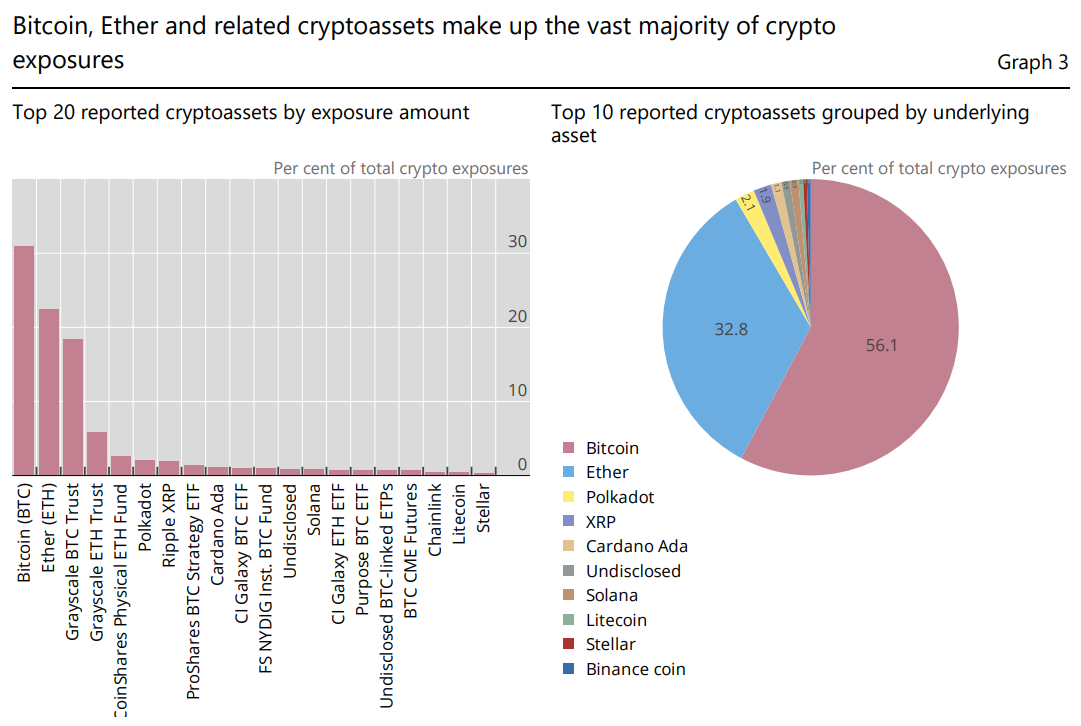

Their report accounted for the crypto asset knowledge from 19 banks, of which ten belonged to North America, seven to Europe, and three others from different areas of the world. Collectively, these banks have reported $10.27 billion in crypto asset publicity in the mean time.

Curiously, Polkadot accounts for a smidge extra publicity than Ripple, coming as much as 2.1% of the entire quantity. Ripple, then again, solely contributed 1.9% to the $10.27 billion crypto publicity. This speaks to the adoption of not simply crypto belongings but additionally XRP among the many banks, as these monetary establishments stay cautious.

Crypto asset publicity

Earlier final week, the Federal Reserve Vice Chairman for Supervision, Michael Barr, commented on the dangers of crypto to the banks, saying that the majority banks are taking a cautious and cautious method with regards to digital belongings, saving them from witnessing main dangers.

The latest rally was anticipated to jumpstart Ripple’s bull run. Nonetheless, till broader market cues, in addition to macro-financial circumstances, flip bullish, the rally may not stick.

XRP value slides additional

XRP value has famous a 13.67% decline previously two weeks, falling from $0.715 to commerce at $0.616 on the time of writing. The drawdown has worn out practically half of the beneficial properties witnessed by Ripple traders previously couple of days, bringing the altcoin near falling via the help line at $0.600.

This stage has been examined as each help and resistance previously and presently acts as an important help line. Bouncing off this line would save Ripple traders from registering additional losses on their holdings and revive the worth rise to push XRP towards $0.644.

The Relative Power Index (RSI) has not damaged beneath the impartial line at 50.0, which suggests it has a shot at noting a bullish consequence.

XRP/USD 1-day chart

Nonetheless, if the $0.600 help line is misplaced, the bullish thesis could be invalidated on the short-term scale. RSI falling beneath the 50.0 mark would function a affirmation of the identical and would possibly draw XRP value right down to $0.551, doubtlessly wiping out all of the beneficial properties famous in the beginning of the month.

Cryptocurrency costs FAQs

Token launches like Arbitrum’s ARB airdrop and Optimism OP affect demand and adoption amongst market contributors. Listings on crypto exchanges deepen the liquidity for an asset and add new contributors to an asset’s community. That is sometimes bullish for a digital asset.

A hack is an occasion during which an attacker captures a big quantity of the asset from a DeFi bridge or scorching pockets of an alternate or some other crypto platform through exploits, bugs or different strategies. The exploiter then transfers these tokens out of the alternate platforms to in the end promote or swap the belongings for different cryptocurrencies or stablecoins. Such occasions usually contain an en masse panic triggering a sell-off within the affected belongings.

Macroeconomic occasions just like the US Federal Reserve’s resolution on rates of interest affect danger belongings like Bitcoin, primarily via the direct influence they’ve on the US Greenback. A rise in rate of interest sometimes negatively influences Bitcoin and altcoin costs, and vice versa. If the US Greenback index declines, danger belongings and related leverage for buying and selling will get cheaper, in flip driving crypto costs greater.

Halvings are sometimes thought-about bullish occasions as they slash the block reward in half for miners, constricting the provision of the asset. At constant demand if the provision reduces, the asset’s value climbs. This has been noticed in Bitcoin and Litecoin.

[ad_2]