[ad_1]

A gaggle of Venmo and Sq. money customers has banded collectively to complain about instantaneous switch charges and trade mistrust in cryptocurrency in what seems to be a frivolous lawsuit filed towards Apple.

The lawsuit’s whole declare hedges on the concept that Apple’s App Store pointers act as a horizontal competitors settlement that might infringe on antitrust legal guidelines. Principally, as a result of Apple requires cryptocurrency peer-to-peer transactions to undergo an alternate, it has given itself, Block, PayPal, and Google Pay a bonus over options.

In response to a report from Reuters, 4 customers are suing Apple on the grounds that the corporate has violated U.S. antitrust legislation by its App Retailer pointers. By requiring cryptocurrency alternate to undergo an middleman like Coinbase, Apple has allegedly created a system that eliminates competitors and promotes steady development in transaction charges.

The lawsuit itself appears to counsel that charges are in all places in Apple Pay, Venmo, and the remaining. Nonetheless, charges solely happen in particular conditions, like when asking for an instantaneous switch or when utilizing funds by an account-linked debit card.

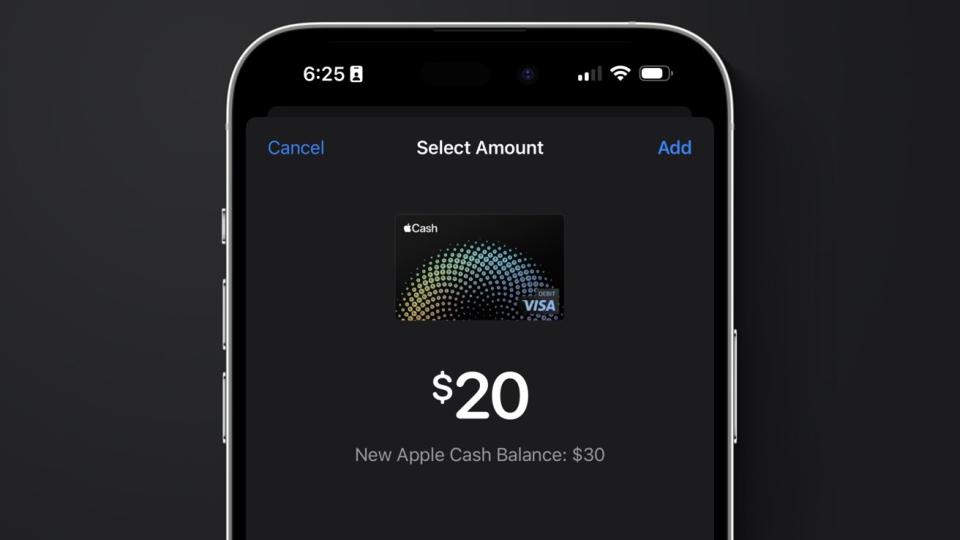

The moment switch price, in Apple Money’s case, is 1.5% with a minimal of $0.25 and a most of $15. You’d need to carry out an instantaneous switch of $1,000 to incur the $15 most price.

The choice is ready one to a few enterprise days for the transaction to switch to the consumer’s financial institution usually.

Alternatively, customers who undergo an older system like MoneyGram need to pay a lot greater charges for a lot much less comfort. Charges begin at about $9 for transfers of about $500 and go as much as $17 for $1,000.

The lawsuit mentions Damus and Zeus continuously. These cryptocurrency-focused apps have been rejected as a result of Apple’s App Retailer pointers.

Comfort prices cash, regardless of this lawsuit’s claims

It appears the plaintiffs wish to switch cash immediately with minimal or no charges, which seemingly is not possible. Because the lawsuit describes, banks that deal with quick transfers need to conduct the transactions utilizing short-term lending to cowl the switch till the transaction clears — which does not occur at no cost.

The lawsuit features a temporary historical past of peer-to-peer cost programs however fails to incorporate the billions misplaced by customers counting on crypto, the pyramid scheme invited by crypto and web3 referred to as NFTs, and the volatility of currencies, making values unknowable minute to minute. The legislation strikes slowly, however it’s unimaginable to see a historical past of crypto not point out the current failure of one of many trade’s largest exchanges and lawsuit towards Sam Bankman-Fried.

The plaintiffs ask that Apple present customers with a wild-west fashion of foreign money alternate with no middleman, no FDIC insurance coverage, and no security measures in place. The proper place for again alley offers that permeate the darkish internet for medicine and illicit pornography, now out there in Apple Pockets.

Comfort charges exist for a purpose and go up with the market. Anticipating in any other case is a mistake that will have been corrected with a little bit of training as an alternative of an costly, frivolous lawsuit that can seemingly fail.

The lawsuit is a wild learn, from together with a portion of the Bitcoin whitepaper to calling the peer-to-peer market an “Apple-led cartel.” The plaintiffs ask for a trial by jury, for Apple to pay for the trial and lawyer charges, and for everybody who’s used Venmo or Money app since November 17, 2019, to be refunded all transaction charges.

[ad_2]