[ad_1]

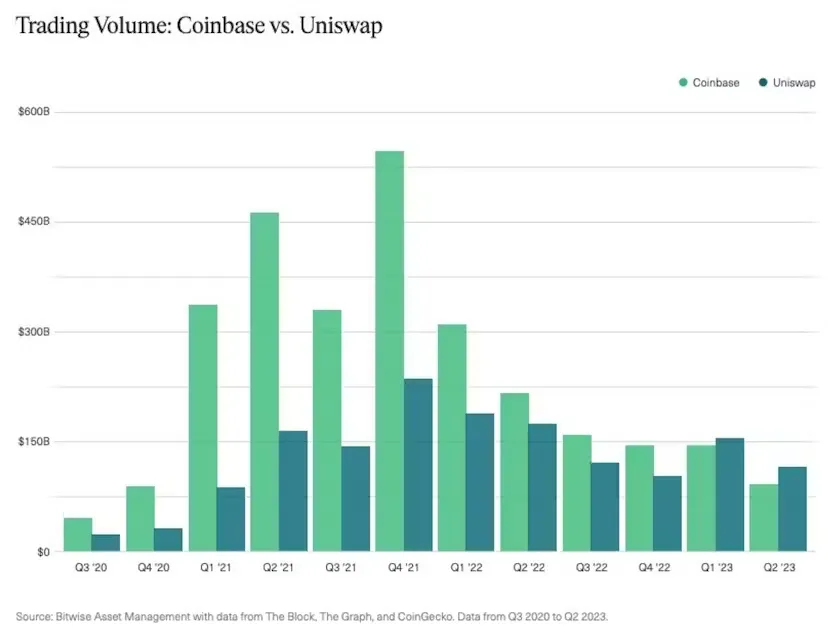

Within the risky cryptocurrency enviornment, merchants repeatedly search platforms that present robustness towards the unpredictability of the market. The decentralized Uniswap change has emerged as a frontrunner, overtaking the favored US change, Coinbase, when it comes to spot buying and selling quantity all through 2023.

Bitwise’s seasoned researcher, Ryan Rasmussen, reveals startling figures: In Q2 2023, Uniswap facilitated trades value roughly $110 billion.

Uniswap Decentralized Trade Features Momentum Over Centralized Coinbase

In stark distinction, Coinbase trailed with a quantity of round $90 billion. This wasn’t an remoted occasion. Within the previous quarter, Uniswap edged out Coinbase by managing trades of $155 billion versus Coinbase’s $145 billion.

Why this migration to Uniswap? The brutal bear market of 2022 delivered a severe blow to centralized crypto corporations like Coinbase, resulting in a big 83% drop in its This fall 2021 spot buying and selling quantity.

Compared, Uniswap, a decentralized protocol, witnessed solely a 50% discount. This means a rising dealer desire for platforms working autonomously primarily based on the immutable legal guidelines of code.

Apparently, regardless of Uniswap’s rising dominance in buying and selling quantity, its native token, UNI, took successful, lowering by 10% in 2023. It stays a staggering 90% under its 2021 peak.

Uniswap Main the DEX Race

Innovation stays on the coronary heart of Uniswap’s technique. June noticed the unveiling of v4, a protocol promising enhanced buying and selling options akin to restrict orders and automatic payment income compounding.

To not be outdone, Uniswap launched UniswapX, a DEX aggregation protocol, simply final month. Designed to streamline buying and selling additional, it ensures merchants the very best costs.

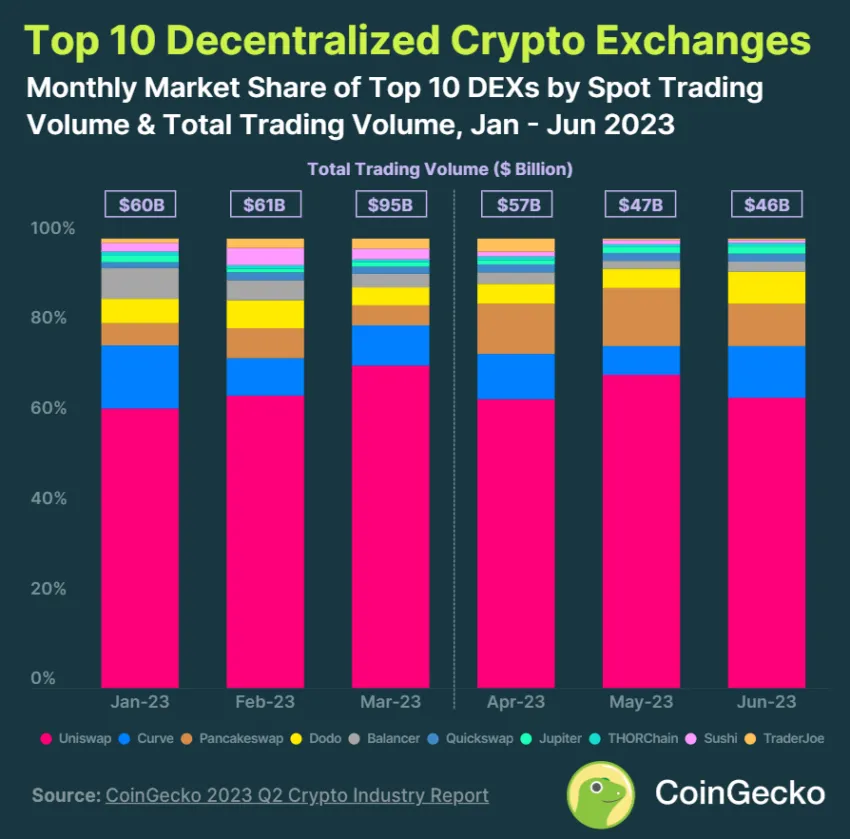

When trying on the broader DEX ecosystem, Uniswap, with a commanding 64.6% market share, is the undisputed chief. Nonetheless, competitors is fierce.

Curve was second in line, boasting an 11.5% share, recording a buying and selling quantity of $5.2 billion in June 2023. Following intently are PancakeSwap and Dodo, with market shares of 9.5% and seven.2% respectively.

It must be famous that since this information was launched, Curve suffered a reentrancy assault and misplaced $62 million on July 30. PancakeSwap has since usurped the second-place rank, pushing Curve to 3rd place.

One of the crucial noteworthy tales from Q2 2023 is that of PancakeSwap. Regardless of a basic downtrend within the DEX buying and selling quantity, PancakeSwap recorded a commendable 48.1% quarter-on-quarter progress.

Its quantity surged from $11.3 billion in Q1 to $16.8 billion in Q2, making it the one DEX to witness such progress in these difficult occasions.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices primarily based on this content material.

This text was initially compiled by a sophisticated AI, engineered to extract, analyze, and arrange info from a broad array of sources. It operates devoid of non-public beliefs, feelings, or biases, offering data-centric content material. To make sure its relevance, accuracy, and adherence to BeInCrypto’s editorial requirements, a human editor meticulously reviewed, edited, and authorized the article for publication.

[ad_2]